No Data

9983 Fast Retailing

- 46250.0

- -250.0-0.54%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Concerns about the escalation of trade friction between the US and China eased, temporarily recovering to the 35,000 yen range.

The Nikkei Average has made a significant rebound for the first time in three days, closing at 34,868.63 yen, up 648.03 yen (with the estimated Volume of 1.8 billion shares). On the 22nd, in the USA, it was reported that U.S. Treasury Secretary Yellen indicated that progress in trade negotiations with China was possible, leading major stock indices to rise by over 2%. In line with this trend, the Nikkei average started on a Buy and quickly climbed to 35,142.12 yen shortly after the trading began. However, it briefly fell by 143 yen in the morning.

Concerns about the decline in U.S. stocks and the appreciation of the yen are present, but there is a sense of underlying strength.

The Nikkei average continued to decline, finishing trading at 34,220.60 yen, down 59.32 yen (Volume estimated at 1.4 billion 30 million shares). Reflecting the drop in major stock indices in the previous day's USA market, selling started ahead. There was a moment right after the opening when it turned positive at 34,340.57 yen, but the buying did not continue, and by the middle of the morning session, it had dropped to 34,109.85 yen. However, nearing the psychological barrier of 34,000 yen, there was a resistance to falling due to the bargains stemming from perceived value, and the yen exchange rate is at its highest in about seven months.

The Nikkei average is down about 125 points, with negative contributions from Tokyo Electron, Fast Retailing, and Advantest ranking at the top.

On the 22nd at around 12:47 PM, the Nikkei Average stock price fluctuated around 34,150 yen, down approximately 125 yen from the previous day. In the afternoon session, selling remained dominant, expanding the decline as trading commenced. The foreign exchange market showed a dollar exchange rate of 140 yen and 10 sen, indicating a stronger yen and weaker dollar compared to early morning levels, which appears to be weighing on stock prices. Among the contributing stocks to the Nikkei Average, Tokyo Electron <8035.T>, Fast Retailing <9983.T>, and Advantest <6857.T> ranked highest in negative contributions.

In a market where participants are limited, the appreciation of the yen is a burden.

The Nikkei average fell for the first time in three trading days. It closed at 34,279.92 yen, down 450.36 yen (with an estimated Volume of 1.4 billion 20 million shares). The strengthening of the yen against the dollar, which rose to the mid-140 yen range, weighed heavily. The Nikkei average widened its decline from the initial high of 34,610.60 yen right after the market opened, and there were instances where it dropped to 34,216.98 yen at the start of the afternoon session. The US stock Index ETF futures traded in negative territory, impacting the US market after the holiday.

List of stocks breaking through clouds (weekly chart) (part 2)

○ List of breakout stocks in the market Code Stock Name Closing Price Leading Span A Leading Span B Tokyo Main Board <6028> TechnoPro HD 3188 2797.25 3097 <6118> Aida 903798821.5 <6201> Toyota Industries 12800 11654.5 12856.5 <6305> Hitachi Construction Machinery 40863 6573898.5 <6309> Tsubakimoto 42954 1703800 <6331>

The Nikkei average rose by 352 yen, continuing to rise significantly, with a strong performance amid few market participants = afternoon session on the 18th.

On the 18th, the Nikkei average stock price in the afternoon session rose significantly by 352.68 yen to 34,730.28 yen compared to the previous day. The TOPIX (Tokyo Stock Price Index) also increased by 28.92 points to 2,559.15 points. In the morning, selling was prevalent due to the decline in US stocks and a stronger yen on the 17th. However, after showing no further selling pressure and stabilizing, it turned upward and expanded its gains. After the initial buying subsided, there were instances of trading in a narrow range, but the European and American stock markets on the 18th were closed for the Good Friday holiday.

Comments

Anyone else love UNIQLO?

$Fast Retailing (9983.JP)$

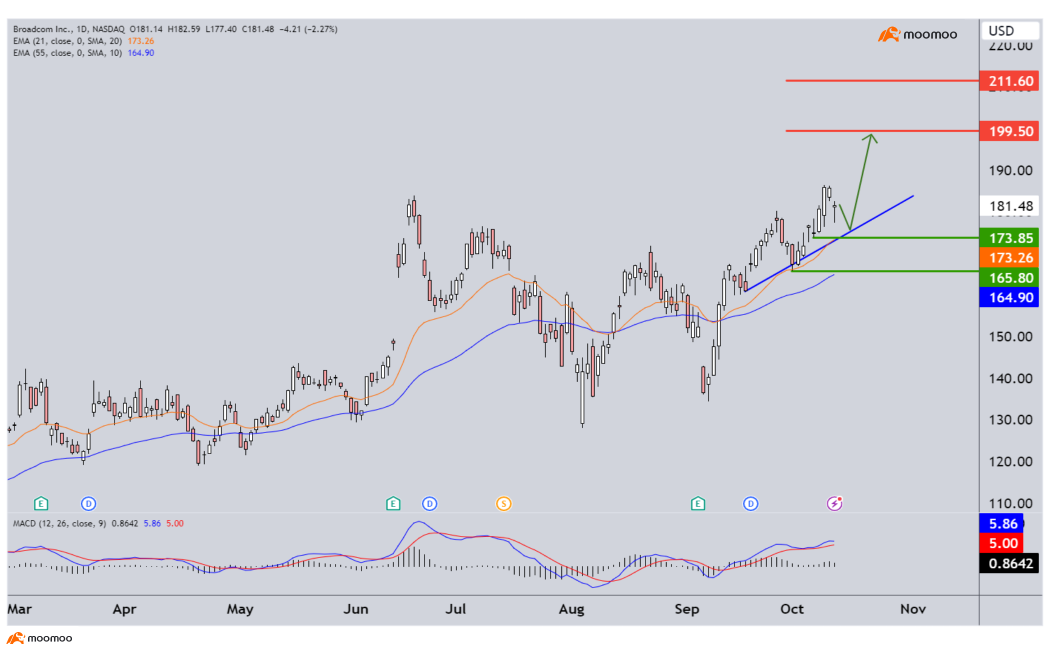

Broadcom Inc (AVGO US) $Broadcom (AVGO.US)$

Daily Chart -[BULLISH ↗ *]AVGO US is holding above its ascending trendline support. As long as price is holding above 173.85 support level, we expect price to drift down towards its ascending trendline support before drifting towards 199.50 resistance level. Technical indicators advocate for a bullish scenario as well.

Alternatively: A daily candlestick closing below 173.85 su...

Pulte Group Inc (PHM US) $PulteGroup (PHM.US)$

Daily Chart -[BULLISH ↗ **] PHM shaped a bullish breakout of ascending wedge. As long as price is holding above 136.28 support, a further push higher towards 152.00 resistance is expected. Technical indicators are advocating for a bullish scenario as well.

Alternatively: A daily candlestick closing below 136.28 support will open a drop towards next support at 129.80...

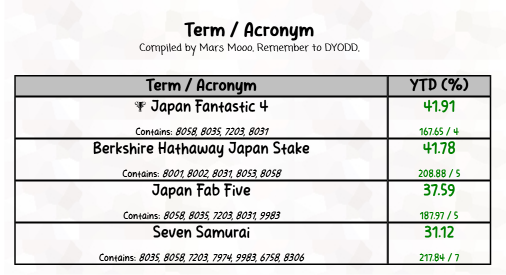

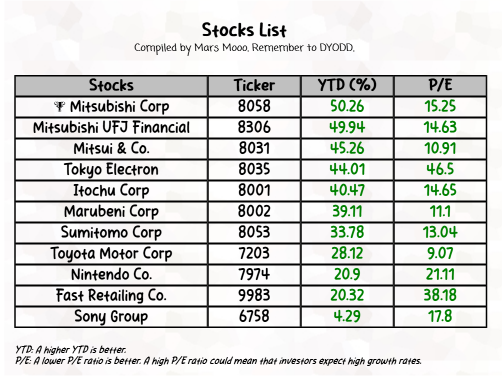

A short overview of equal weighted Seven Samurai (*1), Berkshire Hathaway Japan Stake, the Fab Five, and the Fantastic 4 YTD performance, rounded to 2 decimal places.

A quick overview of the stocks and their YTD performance inside them is provided below.

Do you think their YTD will continue to rise next week

That's all for today, and always remember to DYODD (Do your own due diligence) when makin...

Let's take ...