No Data

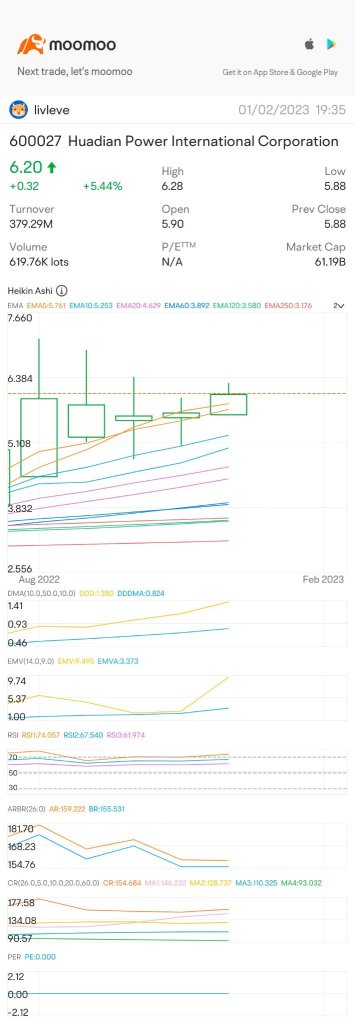

600027 Huadian Power International Corporation

- 5.81

- +0.09+1.57%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Hong Kong stock movement | Huadian Power International Corporation (01071) rises over 3%, plans to acquire assets for 7.167 billion and raise no more than 3.428 billion in supporting funds.

Huadian Power International Corporation (01071) rose over 3%, as of the time of writing, it increased by 3.2%, priced at 4.52 HKD, with a trading volume of 19.3929 million HKD.

Huadian Power International Corporation (600027.SH): Completed the issuance of medium-term notes.

Gelonghui, April 23rd丨HUADIAN POWER (600027.SH) announced that the company has recently completed the issuance of the 2025 fourth phase medium-term notes and the fifth phase medium-term notes of HUADIAN POWER CO., LTD. The issuance amount of the fourth phase medium-term notes for 2025 is 2 billion yuan, with a term of 3+N (3) years, a par value of 100 yuan per unit, and an issuance coupon rate of 2.09%. The fourth phase medium-term notes for 2025 were primarily underwritten by Industrial Bank and Ping An Bank, using a book-building and centralized distribution method in the national interbank bond market.

Huadian Power International's (HKG:1071) Investors Will Be Pleased With Their Solid 168% Return Over the Last Five Years

[Brokerage Focus] CITIC SEC: The new generation of coal and electricity upgrades will contribute to the construction of a new type of Electrical Utilities system.

Jinwu Financial News | CITIC SEC Research Reports indicate that the impact of New energy Fund power generation is increasing, resulting in higher demands for coal power, which plays a fundamental role in the electrical utilities system, pushing for coal power upgrades to assist in the construction of a new type of electrical utilities system. The "New Generation Coal Power Upgrade Special Action Implementation Plan (2025–2027)" covers existing, newly constructed, and demonstration units, adding new indicators or enhancing current indicator requirements, leading to coal power upgrades; it also specifies that energy authorities in provinces and cities should formulate action plans tailored to their regions, controlling the pace independently; by collaborating with the New energy Fund, improving ancillary service markets, and issuing REITs.

Huadian Power International Logs 8.5% Drop in Q1 Output, Sales

Brokerage morning meeting highlights: Focus on sectors benefiting from domestic demand and investment opportunities in new consumer segments.

In today's Brokerage morning meeting, HTSC proposed to focus on investment opportunities in sectors benefiting from domestic demand and new Consumer sub-sectors; China Securities Co.,Ltd. stated that the decrease in Real Estate sales and new starts has significantly narrowed, showing ongoing effectiveness in stabilizing after the decline; Galaxy Securities believes that the coal and electricity regulation ability has been further strengthened, and the reconstruction of the sector's valuation is expected to accelerate.

Comments

Investors Could Be Concerned With Huadian Power International's (HKG:1071) Returns On Capital

Investors Could Be Concerned With Huadian Power International's (HKG:1071) Returns On Capital