No Data

00694 BEIJING AIRPORT

- 2.800

- -0.030-1.06%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Hong Kong stocks are moving | Capital Airport (00694) surged over 5% in the morning; the domestic C909 made its maiden flight at Vientiane Wattay International Airport in Laos.

Capital Airport (00694) rose more than 5% in the morning, as of the time of writing, it rose 5.17%, priced at 2.85 Hong Kong dollars, with a transaction volume of 28.2787 million Hong Kong dollars.

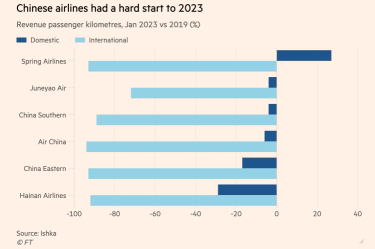

J.P. Morgan: The aviation industry faces significant challenges under the China-U.S. trade war, with Spring Airlines as the top choice.

Under the Sino-US trade war, the aviation/airlines industry faces significant challenges. Due to China imposing a 125% tariff on US imported commodities, the maintenance costs for Airlines and the costs for new aircraft deliveries are expected to rise. Air China Limited (00753) and CHINA SOUTH AIR (01055) are anticipated to be hit the hardest due to the high proportion of Boeing aircraft in their fleets. Furthermore, the USA's 145% tariff on Chinese imported commodities and the removal of the tax exemption threshold is impacting the cargo business of Chinese Airlines, with CATHAY PAC AIR (00293) and China Southern Airlines expecting to bear the brunt.

BEIJING AIRPORT (00694.HK) has signed a location leasing contract.

On April 9, GLONGHUI announced that BEIJING AIRPORT (00694.HK) signed a site leasing contract with a trading company, under which the company will lease designated locations at Terminal 1, Terminal 2, and Terminal 3 of BEIJING AIRPORT to the trading company for one year to provide self-service vending machines selling food and beverage Commodities.

Hong Kong stock movement | Capital Airport (00694) fell over 4%, last year the company's pre-tax losses significantly narrowed, Institutions stated that the increase in income tax dragged down performance.

Beijing Capital International Airport (00694) fell over 4%, as of the time of writing, it has declined by 4.35%, trading at 2.42 Hong Kong dollars, with a transaction amount of 5.4401 million Hong Kong dollars.

Hong Kong stocks movement | The Aviation/airlines Industry has declined across the board. Trade frictions may affect the civil aviation demand side. Oil prices have plummeted, and airline companies are expected to benefit significantly from reduced costs.

The aviation/airlines industry is experiencing a decline across the board. As of the time of writing, China Eastern Airlines (00670) has dropped 13.89% to HKD 2.17; China Southern Airlines (01055) has decreased 13.01% to HKD 3.01; Air China Limited (00753) has fallen 11.74% to HKD 4.21; and Capital Airport (00694) is down 10.83% to HKD 2.47.

[Brokerage Focus] Guotai Haitong SEC: As supply and demand recover, the marketization effect of ticket prices will help the airlines' profit center rise.

Jingwu Financial News | Cathay HAITONG SEC stated, "To relax passenger transportation prices on domestic civil aviation routes with competitive conditions" - it is expected to deepen the ticket pricing marketization mechanism to ensure supply and demand pricing. The marketization of China’s civil aviation ticket prices established its goal in 2004, accelerated in 2010, and in 2013 switched pilot trunk routes to market-adjusted prices (increasing the full ticket price by 10% each season according to regulations). In 2015, the "Several Opinions on Promoting Price Mechanism Reform" pushed the Civil Aviation Administration to accelerate ticket price marketization during the 13th Five-Year Plan period. By the end of 2017, 5+ airlines were allowed to co-operate on routes; by the end of 2020, 3+ airlines were allowed to co-operate on routes.

Comments

$TENCENT (00700.HK)$ │Overweight

$Kweichow Moutai (600519.SH)$ │Overweight

$BABA-W (09988.HK)$ │Overweight

$PETROCHINA (00857.HK)$ │Overweight

$PDD Holdings (PDD.US)$ │Overweight

$AIA (01299.HK)$ │Overweight

$MEITUAN-W (03690.HK)$ │Overweight

$BYD COMPANY (01211.HK)$ │Overweight

$NTES-S (09999.HK)$ │Overweight

$Midea Group Co., Ltd (000333.SZ)$ │Overweight

$HKEX (00388.HK)$ │Overweight

$BIDU-SW (09888.HK)$ │Overweigh...

On January 6, the CAAC claimed that it would increase the proportion of international aviation, cargo aviation, regional aviation, and general aviation in the civil aviation business, accelerate the construction of a new pattern of opening up civil aviation to the outside world and strive for an overall recovery to the pre-epidemic level of 75%.

Just past ...

It will go up to 5.00, We just wait for it🥲🥲

Medium & Long Term - Monopoly

markets. I believe people's will stay away from this stock.

markets. I believe people's will stay away from this stock.