No Data

002142 Bank Of Ningbo

- 24.83

- +0.35+1.43%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Public Companies Among Bank of Ningbo Co., Ltd.'s (SZSE:002142) Largest Shareholders, Saw Gain in Holdings Value After Stock Jumped 5.0% Last Week

Research Reports Gold Mining | Zheshang: Bank Of Ningbo's dividend payout ratio increases, maintaining a 'Buy' rating.

The Zheshang Research Report indicates that Bank Of Ningbo (002142.SZ) has a revenue growth of +8.2% year-on-year and a parent Net income growth of +6.2% for 2024, compared to +0.7pc and -0.8pc in the first three quarters of 2024, respectively. The revenue growth rate has improved on a quarter-on-quarter basis, mainly benefiting from the recovery of the interest margin and the improvement of drag factors. Bank Of Ningbo plans a dividend payout ratio of 22.8% for 2024, significantly increasing by 6.8pc compared to 2023, with an expected dividend yield of 3.85% corresponding to 2024 by April 9, 2025, fully demonstrating Bank Of Ningbo's sincerity in returning to Shareholders. Looking ahead, Bank Of Ningbo's revenue is expected to maintain a small...

Bank of Ningbo 2024 Profit Up 6%; Shares Climb 3%

Bank of Ningbo: 2024 Annual Report

Bank of Ningbo: 2024 Annual Report Summary

Bank Of Ningbo (002142.SZ): The Net income for the fiscal year 2024 is expected to be 27.127 billion yuan, with a proposed distribution of 9 yuan per share.

On April 9, Gleonghui reported that the Bank Of Ningbo (002142.SZ) announced its annual report for 2024, achieving revenue of 66.631 billion yuan, an increase of 8.19% year-on-year; total profit of 31.286 billion yuan, an increase of 12.14% year-on-year; net income attributable to shareholders of the parent company of 27.127 billion yuan, an increase of 6.23% year-on-year; net income attributable to shareholders of the parent company after deducting non-recurring gains and losses of 27.302 billion yuan, an increase of 7.38% year-on-year; basic EPS of 3.95 yuan; proposed cash dividends of 9 yuan per 10 shares (including tax).

Comments

$Luxshare Precision Industry (002475.SZ)$

$Hangzhou Hikvision Digital Technology (002415.SZ)$

$Muyuan Foods (002714.SZ)$

$NAURA Technology Group (002371.SZ)$

$CGN Power Co.,Ltd. (003816.SZ)$

$S.F. Holding (002352.SZ)$

$Bank Of Ningbo (002142.SZ)$

$Jiangsu Yanghe Distillery (002304.SZ)$

$Guosen (002736.SZ)$

$Iflytek Co.,ltd. (002230.SZ)$

$Focus Media Information Technology (002027.SZ)$

$Rongsheng Petro Chemical (002493.SZ)$

$Zhejiang Sanhua Intelligent Controls (002050.SZ)$

���������...

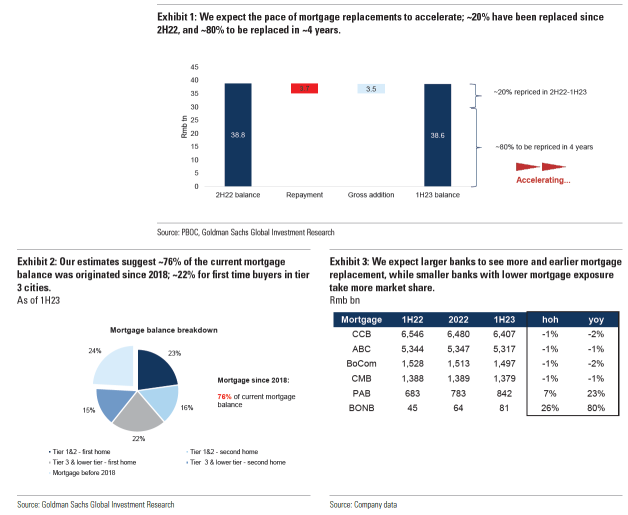

We expect 1) the pace of mortgage replacements to accelerate on a one-off rate cut on existing mortgages. Previously, we estimated ~4 more years to complete the mortgage replacement, assuming ~10% replacement completes in a half year and that the replacement cycle started in 2H22, and that ~20% of the mortgage book had been remortgaged by end-1H23.(...