No Data

ZTO ZTO Express

- 19.010

- -0.070-0.37%

- 19.040

- +0.030+0.16%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

20-F: FY2024 Annual Report

ZTO EXPRESS-W: 2024 Annual Report

ZTO Files Annual Report on Form 20-F for Fiscal Year 2024

【Brokerage Focus】Hua Fu Securities maintains a "Buy" rating on ZTO Express (02057), stating that it has a strong and balanced franchise network.

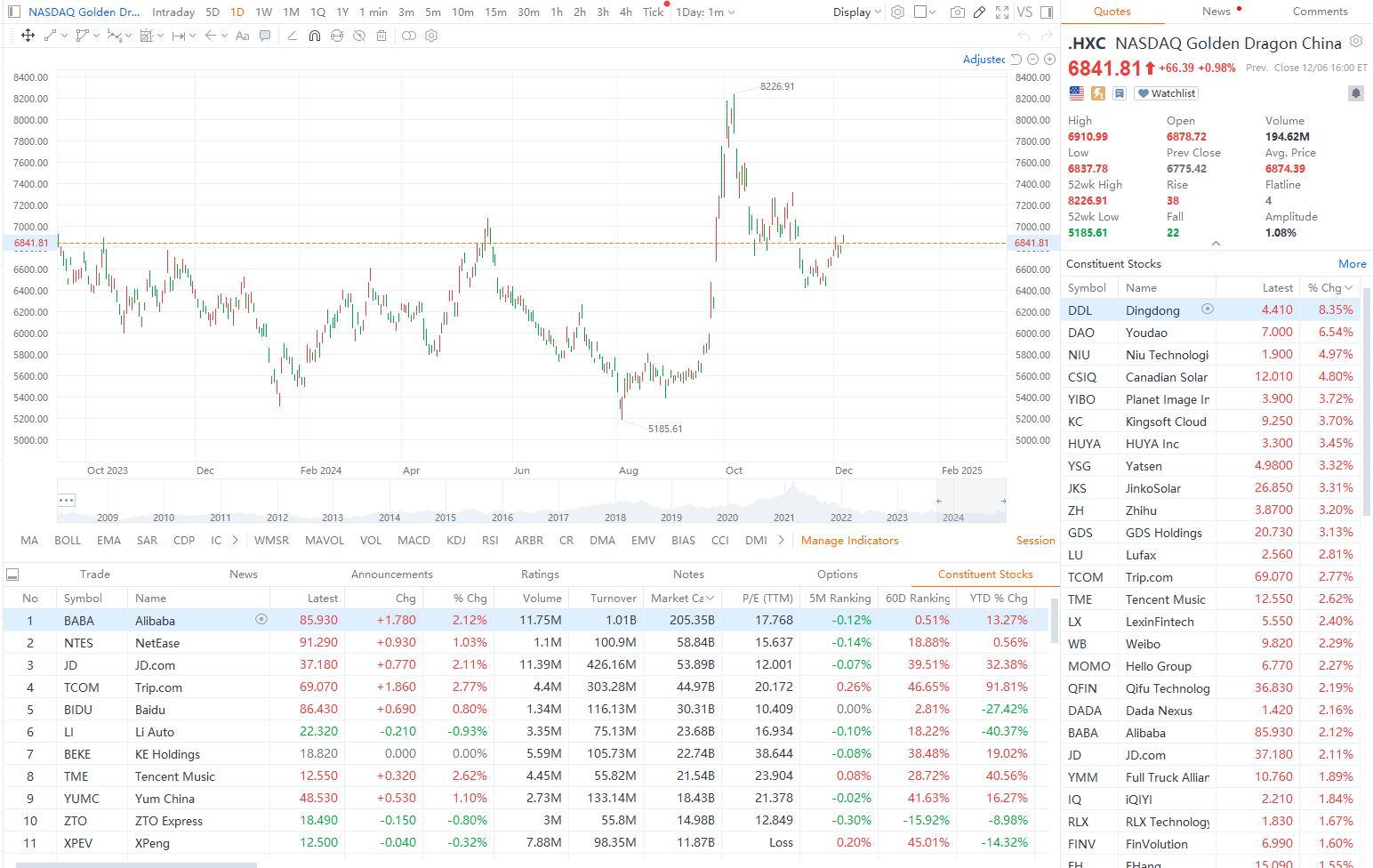

Jingwu Finance News | Huafu Securities Research Reports indicate that ZTO Express (02057) announced full-year performance for 2024, achieving revenue of 44.28 billion yuan, an increase of 15.3% year-on-year; Net income: 8.82 billion yuan, an increase of 0.8% year-on-year. Looking at the single quarter, revenue for Q4 2024 was 12.92 billion yuan. In 2024, the number of express parcels reached 34.01 billion, a growth of 12.6% year-on-year, with a market share of 19.4%, down by 3.4 percentage points year-on-year. Based on current market conditions and Operation, the company estimates that parcel volume in 2025 will be between 40.8 billion and 42.2 billion, representing a year-on-year growth of 20.

HSBC Upgrades ZTO Express(ZTO.US) to Buy Rating, Raises Target Price to $22

HSBC Upgrades ZTO Express (Cayman) to Buy, Announces $22 Price Target

Comments

The consensus estimate for revenues is expected to come in at $1.66 billion which indicate an increase of 10.8% compared to same period last year.

The earnings per share consensus estimate for ZTO is expected to come in at 45 cents, this is an increase of more than 5% compared to same period one year ago.

ZTO Express (ZT...

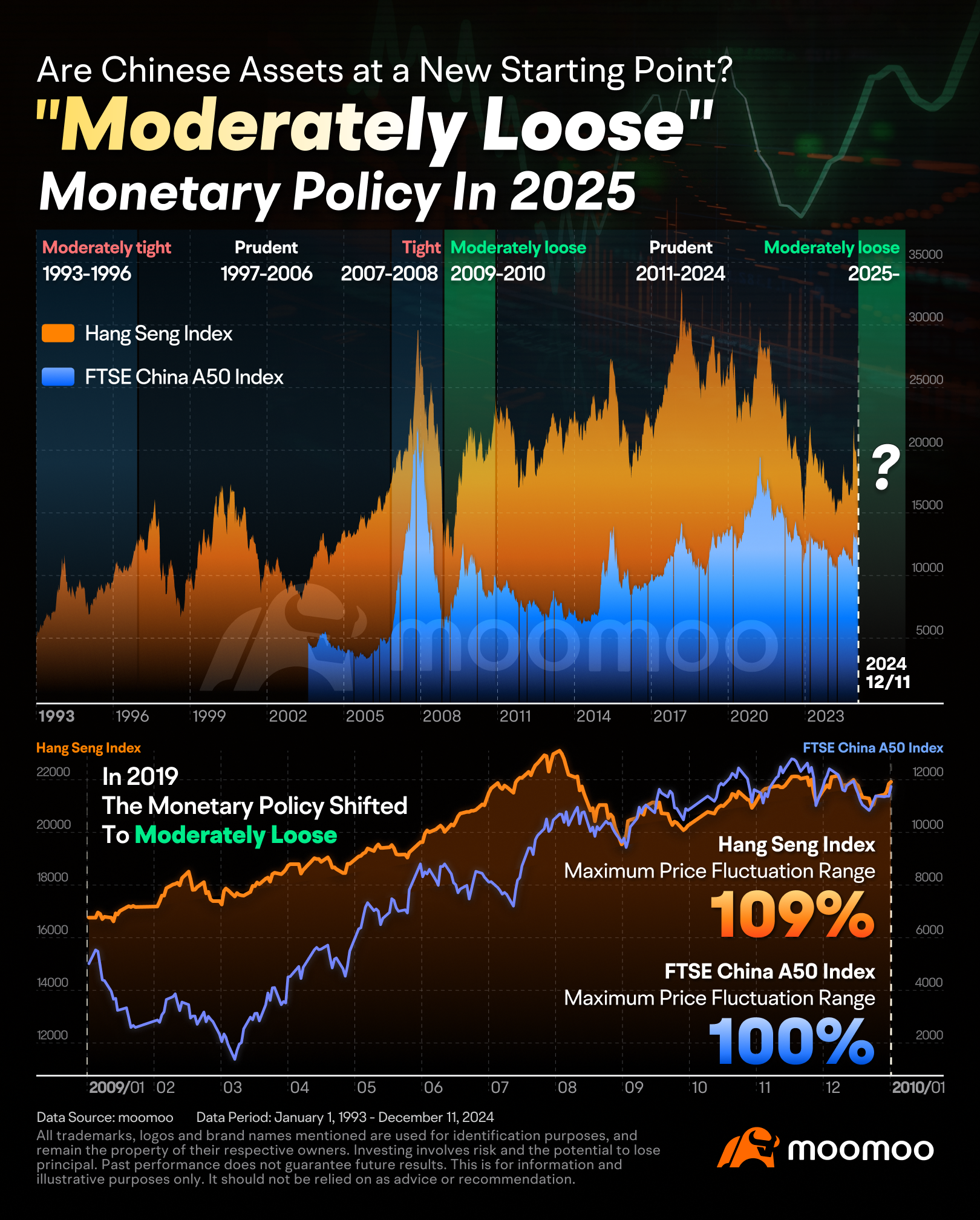

What does the Central Economic Work Conference discuss?

The conference typically comprises two main components: evaluating the...

During a session led by Premier Li Qiang, The State Council passed a policy document last Friday that seeks to expand export growth through the growing sector of international e-commerce. The...