US ETFDetailed Quotes

VT Vanguard Total World Stock ETF

- 115.250

- +1.970+1.74%

Close Apr 24 16:00 ET

115.340High113.260Low

115.340High113.260Low3.14MVolume113.260Open113.280Pre Close360.17MTurnover0.86%Turnover Ratio--P/E (Static)366.33MShares123.57652wk High--P/B42.22BFloat Cap100.89052wk Low2.26Dividend TTM366.33MShs Float123.576Historical High1.96%Div YieldTTM1.84%Amplitude33.260Historical Low114.684Avg Price1Lot Size

Don't trust yourself being able to pick the winners? Just buy the whole market, and let the Market Cap weighted ETF automate it for you.

DCA $Vanguard Total World Stock ETF (VT.US)$ all the way.![]()

DCA $Vanguard Total World Stock ETF (VT.US)$ all the way.

9

4

Don't trust yourself being able to pick the winners? Just buy the whole market, and let Market Cap weighted ETF automate it for you.

DCA $Vanguard Total World Stock ETF (VT.US)$ all the way.![]()

DCA $Vanguard Total World Stock ETF (VT.US)$ all the way.

7

Warran Buffet once said that S&P 500 index fund is the best investment to own for most people. He also said that after he dies, 90% of his wife's inheritance will go into the low cost S&P 500 index fund.

Let's face it - stock picking requires a lot of time and skills (and some lucks of course) Hence, ETF has become an increasingly popular investment option with its various benefits such as diversification, self adjusting and low cost etc.

I started my investment journey i...

Let's face it - stock picking requires a lot of time and skills (and some lucks of course) Hence, ETF has become an increasingly popular investment option with its various benefits such as diversification, self adjusting and low cost etc.

I started my investment journey i...

35

10

10

Was just looking at some year to date performances of the etfs I own. As of this morning:

$VANGUARD ALL EQUITY ETF PORTFOLIO ETF UNITS (VEQT.CA)$ is up 12.51%

$Vanguard Total World Stock ETF (VT.US)$ is up 11.08%

$VANGUARD ALL EQUITY ETF PORTFOLIO ETF UNITS (VEQT.CA)$ is up 12.51%

$Vanguard Total World Stock ETF (VT.US)$ is up 11.08%

1

If you wanna start investing then you can just pick one and start.

1️⃣ Vanguard S&P 500 ETF ( $Vanguard S&P 500 ETF (VOO.US)$ ): Vanguards’ S&P 500 index fund tracks the S&P 500,

Expense ratio of just 0.03%.

2️⃣ Fidelity ZERO Large Cap Index Fund (): If you don’t want the fees at all then Fidelity’s S&P 500 tracker, promises the expense ratio of 0.00% (no fees!). My personal favorite.

3️⃣ Schwab U.S. Broad Market Index ETF ( $Schwab US Broad Market ETF (SCHB.US)$ )...

1️⃣ Vanguard S&P 500 ETF ( $Vanguard S&P 500 ETF (VOO.US)$ ): Vanguards’ S&P 500 index fund tracks the S&P 500,

Expense ratio of just 0.03%.

2️⃣ Fidelity ZERO Large Cap Index Fund (): If you don’t want the fees at all then Fidelity’s S&P 500 tracker, promises the expense ratio of 0.00% (no fees!). My personal favorite.

3️⃣ Schwab U.S. Broad Market Index ETF ( $Schwab US Broad Market ETF (SCHB.US)$ )...

6

2

I think as investors we would also want to have some assets which are resilient to any uncertainty brought by economic events, for example, interest rates hike.

We know that interest rate hike is not new. The Federal Reserve has been raising interest rates for a year now, which has created some uncertainty in the markets.

However, despite rising rates and market uncertainty, we should stay disciplined ...

We know that interest rate hike is not new. The Federal Reserve has been raising interest rates for a year now, which has created some uncertainty in the markets.

However, despite rising rates and market uncertainty, we should stay disciplined ...

+1

7

4

After the Swiss National bank loaned Credit Suisse 50 billion Swiss francs to provide additional liquidity, it also facilitated UBS's acquisition of Credit Suisse for 3 billion Swiss francs, curbing a confidence crisis that could have spread to global financial markets.

The Credit Suisse crisis comes after a week of bankruptcies of Silvergate Bank, Silicon Valley Bank and Signature Bank that triggered a surge in pressure o...

The Credit Suisse crisis comes after a week of bankruptcies of Silvergate Bank, Silicon Valley Bank and Signature Bank that triggered a surge in pressure o...

25

4

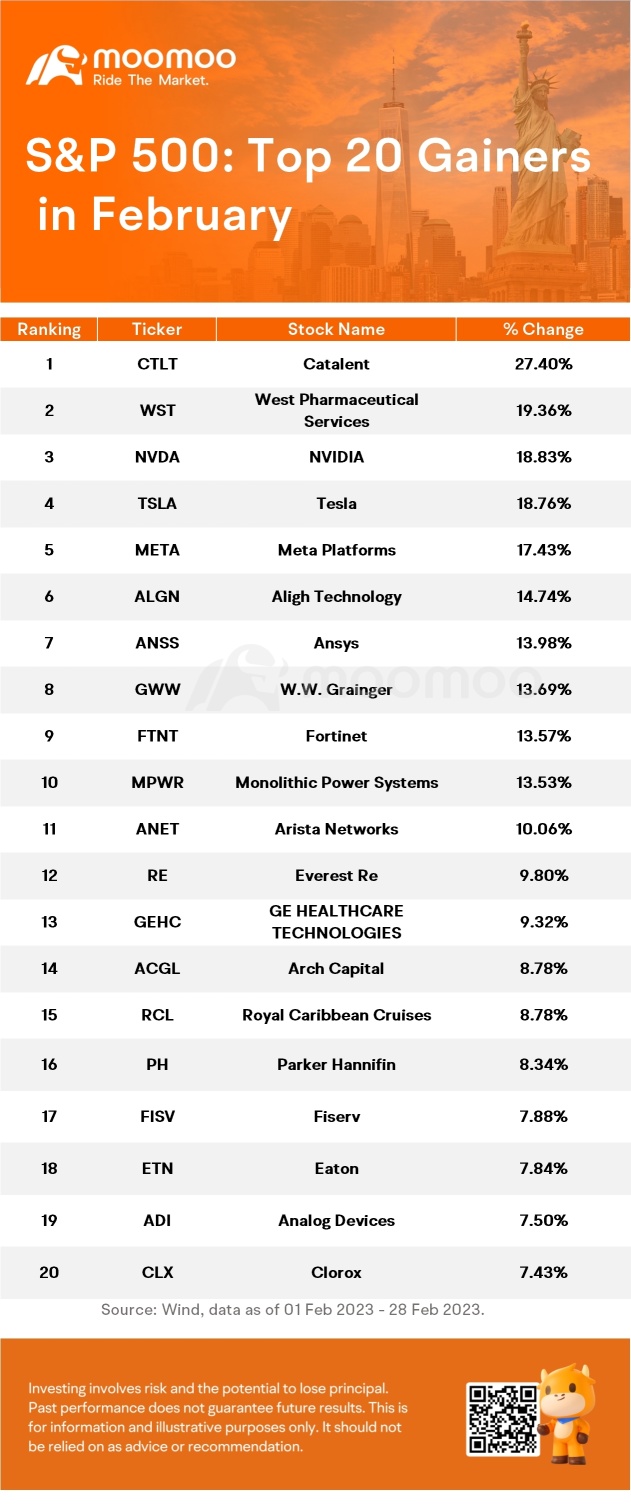

The S&P 500 experienced an overall pullback in February, with a monthly decline of 2.61%. However, there are surprises in the performance of some S&P 500 companies, with the most bullish stocks gaining 27.4% during the month!

Star companies like $NVIDIA (NVDA.US)$, $Tesla (TSLA.US)$ and $Meta Platforms (META.US)$ also continued their rebound trend, rising 18.83%, 18.76% and 17.43% respectively.

In terms of ma...

Star companies like $NVIDIA (NVDA.US)$, $Tesla (TSLA.US)$ and $Meta Platforms (META.US)$ also continued their rebound trend, rising 18.83%, 18.76% and 17.43% respectively.

In terms of ma...

Expand

Expand 36

4

9

Let's talk about how to invest in 2022 against the backdrop of interest rate hikes, and what exactly is considered low-risk.

1. First of all, to clarify a point: no financial management is completely and utterly risk-free. Even if you don't invest anything, just take the cash, it will be affected by the exchange rate and inflation, so there is no absolute safety of money in the world.

2.Low-risk finance means, first of all, robustness in terms of legal ...

1. First of all, to clarify a point: no financial management is completely and utterly risk-free. Even if you don't invest anything, just take the cash, it will be affected by the exchange rate and inflation, so there is no absolute safety of money in the world.

2.Low-risk finance means, first of all, robustness in terms of legal ...

6

2

No comment yet

is really informative for newbies like me

is really informative for newbies like me

Reg3e OP : Learn. Trade. Win

Jackie Hampton : I'm beginner, and when you say 'just buy the whole market'? what exactly does that mean?

Reg3e OP Jackie Hampton : It means investing in a broad market ETF such as VT. It hold thousands of stocks worldwide, so you're diversified across global companies, reducing the risk of being stuck with individual companies, sector, or country performing poorly.

Since ETF like VT is based on Market Cap, poor performing companies will automatically hold less % in your portfolio, while those performing well will gain more % in your portfolio, as reflected in their company growth/market value.

Jackie Hampton : Thank you.. that makes sense..