No Data

TLT250425C71000

- 0.00

- 0.000.00%

- 5D

- Daily

No Data

News

Fed's Waller Says Policymakers Can 'Look Through' One-Time Price Increases

China Calls on Trump to Drop Tariffs; Says Talks Are 'Fake News'

US Companies Stock Up Ahead of Tariffs, Boosting Durable-Goods Orders

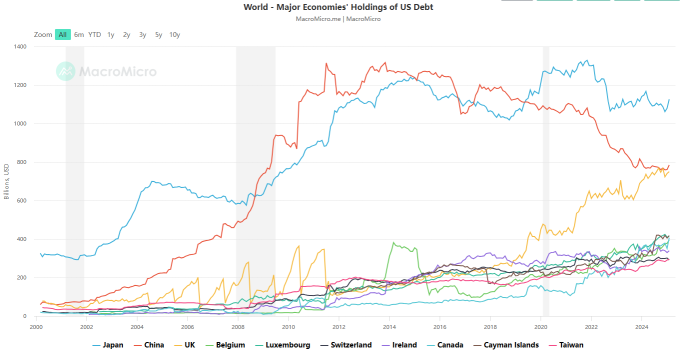

The USA debt crisis is approaching, and BTC will reach a new high again.

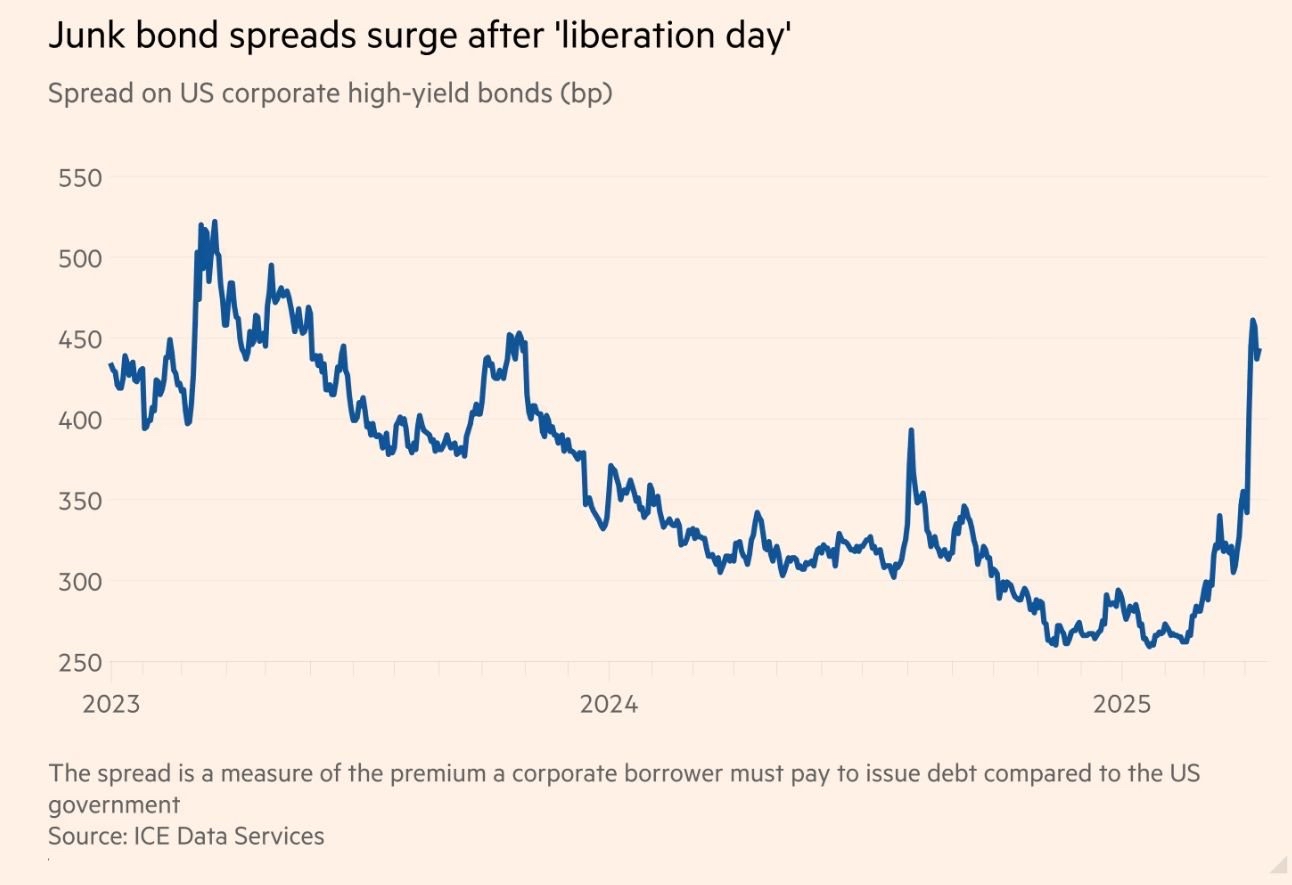

An imbalanced world of policies, a world where trust is scarce, a world where debt is monetized - these are the main sources of Bitcoin's greatest bull market.

The long-term bear market for the US dollar has arrived! Deutsche Bank: This will have a profound impact on the Global economy and capital flows.

Deutsche Bank believes that the dollar bull market has ended and a bear market has begun. The core reasons include a decrease in the global willingness to finance the U.S. twin deficits, a peak in the holdings of U.S. Assets, and a tendency among many countries to promote growth through domestic fiscal measures. The EUR/USD Exchange Rates are expected to reach 1.15 by the end of 2025, gradually approaching 1.30 thereafter.

Is Recession 'Inevitable'? Markets Say Don't Be so Sure.

Comments

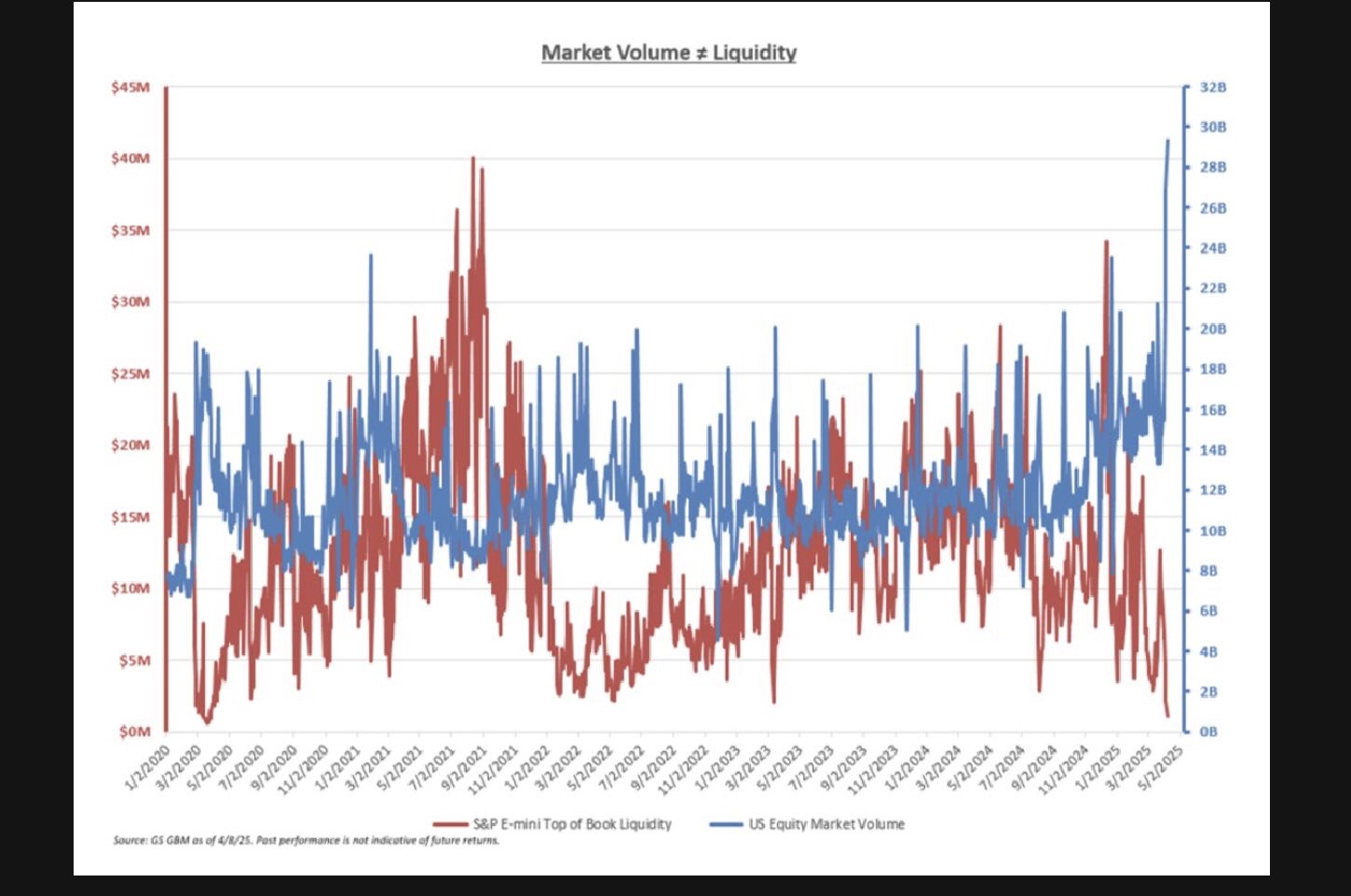

Unfortunately this norm is very likely to continue for weeks, if not months.

This market will continue to be driven my tariffs related news. Not to forget, earnings season is ramping up, which will further complicate things. Invest safe!

$Trump Media & Technology (DJT.US)$ $Bitcoin (BTC.CC)$ $Strategy (MSTR.US)$ $Super Micro Computer (SMCI.US)$ $MARA Holdings (MARA.US)$ $Lululemon Athletica (LULU.US)$ $Johnson & Johnson (JNJ.US)$ $Intel (INTC.US)$ $Disney (DIS.US)$ $Financial Select Sector SPDR Fund (XLF.US)$ $Enphase Energy (ENPH.US)$ $Dow Jones Industrial Average (.DJI.US)$ $iShares 20+ Year Treasury Bond ETF (TLT.US)$ $DiDi Global Inc (DIDIY.US)$ $Alibaba (BABA.US)$ $TENCENT (00700.HK)$

By Robert Musella – Founder of The Roman Sun Tzu Method™

⸻

“The battlefield is shifting—and only the prepared will survive.”

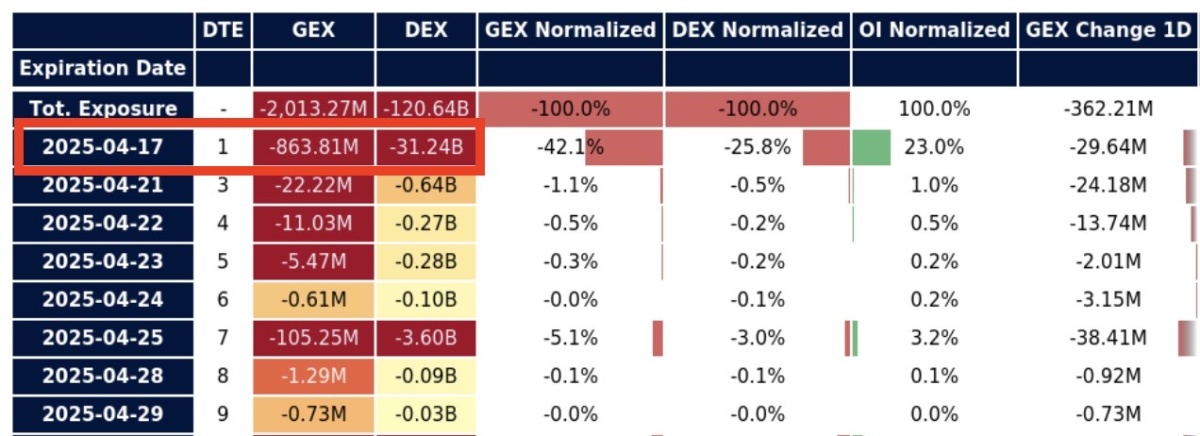

On April 17, we’re not just witnessing expiration-driven chop. We’re watching a multi-front war unfold across equities, credit, options, and global macro flows.

Let’s break down the signals that matter—and what they mean for your next move...

U.S. Treasury bonds are issued by the U.S. government to borrow money from the market, promising repayment of princip...

The 3 major indexes are on track to clinch their third straight winning sessions.

Today’s movement looks more tamed than the last 2 weeks. Wall Street getting used to tariff uncertainty? Or because Trump hasn’t come out to shock and spoil the world again?

$Boeing (BA.US)$ $Johnson & Johnson (JNJ.US)$ $Logitech International (LOGI.US)$ $Micron Technology (MU.US)$ $GlobalFoundries (GFS.US)$ $Peloton Interactive (PTON.US)$ $Corsair Gaming (CRSR.US)$ $Upstart (UPST.US)$ $Clover Health (CLOV.US)$ $Zoom Communications (ZM.US)$ $Crude Oil Futures(JUN5) (CLmain.US)$ $Merck & Co (MRK.US)$ $iShares 20+ Year Treasury Bond ETF (TLT.US)$ �...

CaptainBoi : Will continue for the rest of the year

jian1133 CaptainBoi : I think this week it is advisable to Hold.

KC67 Chan CaptainBoi : By year end , SPY probabaly like 50 or something lol

怪懒神 OP KC67 Chan : lol, impossible la![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

CaptainBoi KC67 Chan : Honestly I hope. If buffet buy you buy. Rn he’s waiting at the 300s or low 400s. He’s also old af so he might honestly be gone before he sees the end of the bear market

View more comments...