No Data

QID250516P30000

- 0.00

- 0.000.00%

- 5D

- Daily

No Data

News

S&P 500's Rapid Exit From Correction Territory Hinged on Trump's Walk-backs of Tariffs and Fed Fight

U.S. stocks closed: The Federal Reserve wields the flag of interest rate cuts, and the S&P has risen for three consecutive days, approaching a key resistance level.

1. Federal Reserve officials discuss the outlook for a June interest rate cut, with the Nasdaq rising over 2% for three consecutive days; 2. Analyst: Pay attention to the key resistance level of 5,500 points for the S&P; 3. Switch 2 causes a global frenzy, impacting records in the Consumer Electronics market; 4. Apple's AI head loses power again, as a mysterious Siasun Robot&Automation team shifts under the Hardware supervisor.

U.S. Labor Market Showed Strength in Q1, but Future Hiring May Slow Vanguard Says

U.S. Durable Goods Orders Jump Ahead of Tariff Blitz

Express News | Fed's Hammack: Fed Could Move in June if Data Is Clear About Economy's State

Express News | U.S. Durable Goods Orders (MoM) For March 9.2% Vs 2% Est.; 0.9% Prior

Comments

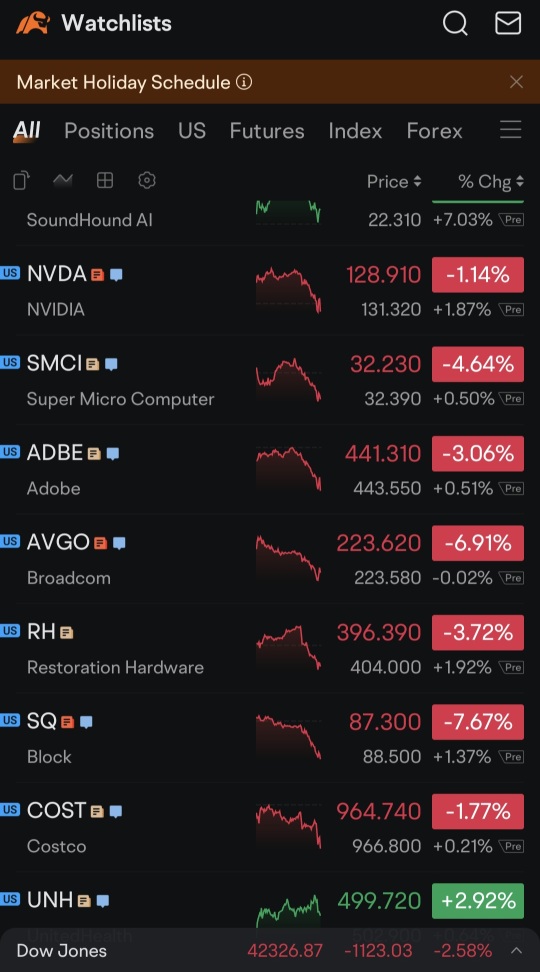

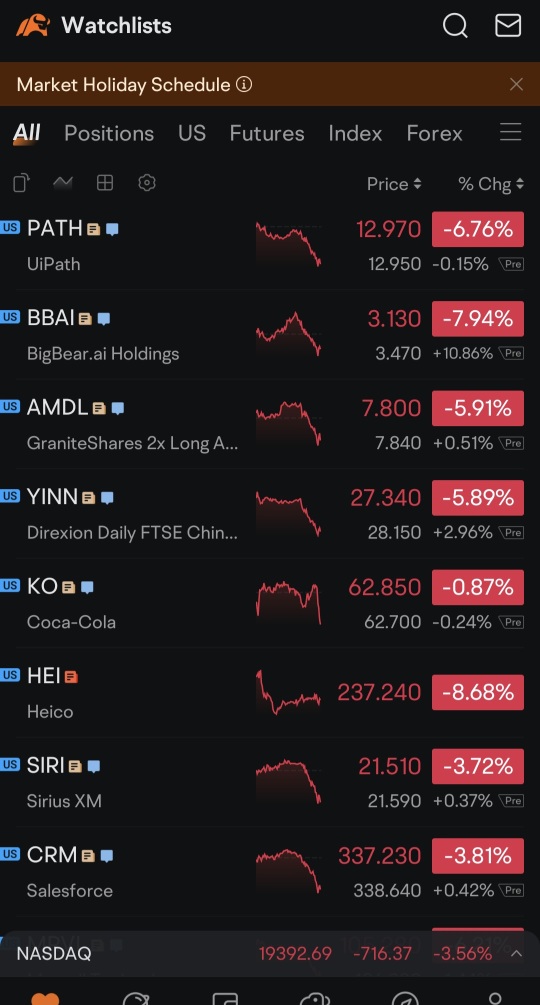

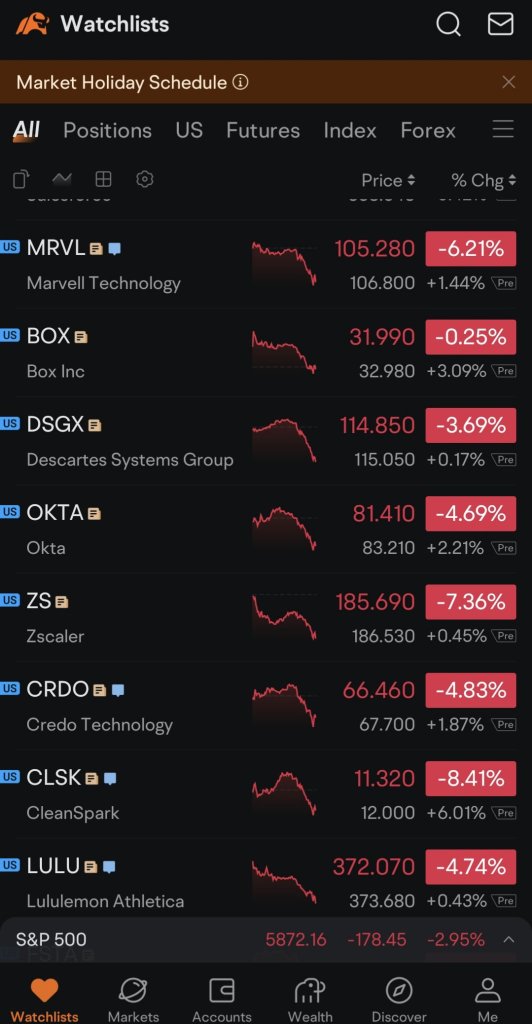

You name it any stock on my watchlist, and you shall see all are red. The only stocks that green yesterday are QID, SQQQ, UNH, and Quantam companies.

$UnitedHealth (UNH.US)$

Do any of you think this is because everyone sold their stock out or some hedge fund sell w...

On Friday, the markets looked very tired and exhausted for moving upward. The volumes were veey small and on a Friday, normally the buy the dippers should float the markets up. However we did not see rhat. Even semicon chip stock AVGO had a monster pop, up 25% the NASDAQ was only up 24 points and S&P 500 ended the day flat. FYI , AVGO is a number 8 stock on market cap right after the mag 7. AVGO is also a trillion market cap chi...