US Stock MarketDetailed Quotes

PG Procter & Gamble

- 157.540

- -8.190-4.94%

Trading Apr 24 10:58 ET

369.41BMarket Cap25.09P/E (TTM)

160.955High157.020Low5.92MVolume160.710Open165.730Pre Close939.28MTurnover0.25%Turnover Ratio26.17P/E (Static)2.34BShares178.87552wk High7.33P/B368.86BFloat Cap155.19852wk Low3.96Dividend TTM2.34BShs Float178.875Historical High2.51%Div YieldTTM2.37%Amplitude12.819Historical Low158.719Avg Price1Lot Size

Procter & Gamble Stock Forum

Before the Bell U.S.

U.S. stock futures wavered following consecutive gains on Wall Street.

Futures tied to the $E-mini S&P 500 Futures(JUN5) (ESmain.US)$ fell 0.31%. $E-mini NASDAQ 100 Futures(JUN5) (NQmain.US)$ went down by 0.33%, and $E-mini Dow Futures(JUN5) (YMmain.US)$ went down 210 points, or 0.53%.

Top News

U.S. Considers Cutting China Tariffs to 50-65%

The Trump administration is considering reducing tariffs on Chinese im...

U.S. stock futures wavered following consecutive gains on Wall Street.

Futures tied to the $E-mini S&P 500 Futures(JUN5) (ESmain.US)$ fell 0.31%. $E-mini NASDAQ 100 Futures(JUN5) (NQmain.US)$ went down by 0.33%, and $E-mini Dow Futures(JUN5) (YMmain.US)$ went down 210 points, or 0.53%.

Top News

U.S. Considers Cutting China Tariffs to 50-65%

The Trump administration is considering reducing tariffs on Chinese im...

Expand

Expand 35

18

46

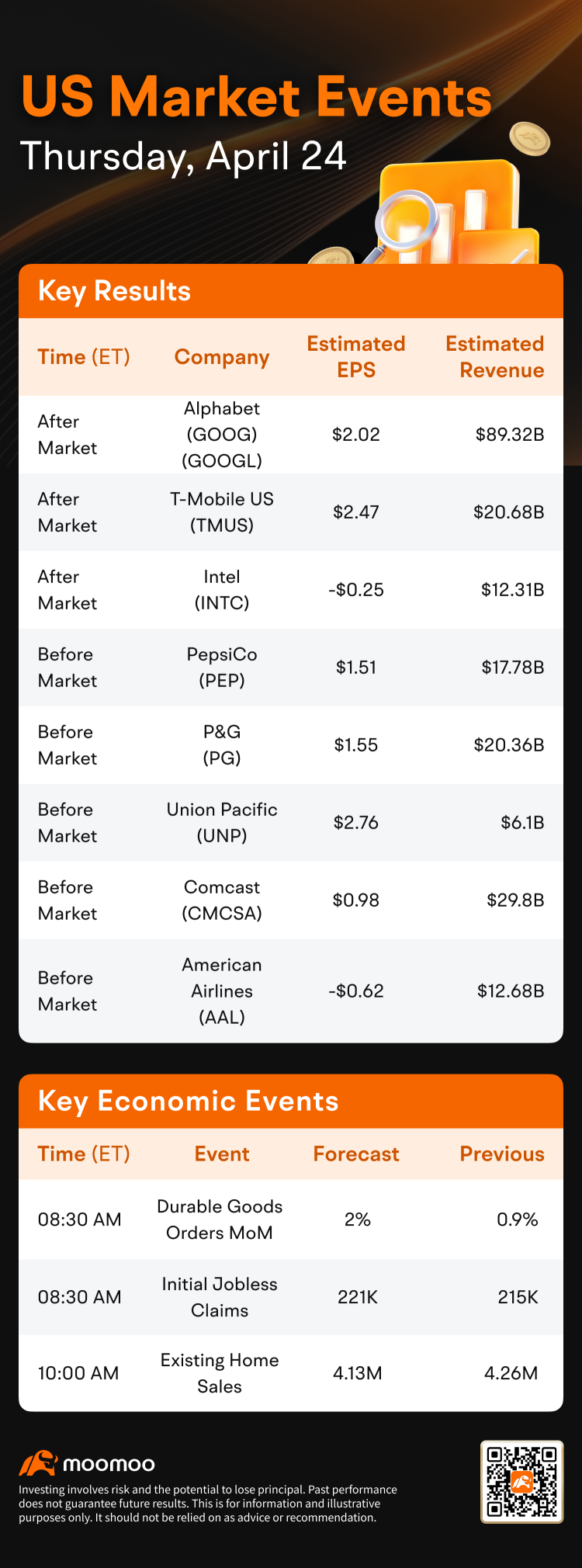

$Procter & Gamble (PG.US)$ is scheduled to announce its Q3 fiscal 2025 results on Thursday, April 24, 2025, before the market opens.

Revenue: Revenue is forecasted to be approximately $20.3 billion to $20.34 billion, indicating very modest growth of about 0.7% compared to the prior-year quarter.

Earnings Per Share (EPS): Wall Street analysts expect EPS to be around $1.54 to $1.55. This represents a slight year-over-ye...

Revenue: Revenue is forecasted to be approximately $20.3 billion to $20.34 billion, indicating very modest growth of about 0.7% compared to the prior-year quarter.

Earnings Per Share (EPS): Wall Street analysts expect EPS to be around $1.54 to $1.55. This represents a slight year-over-ye...

+1

20

3

1

One sniper shot, one clean hit. Entry at the sweep, TP near the top. No overtrading, just precision. Looking forward to tomorrow's setup.

$NVIDIA (NVDA.US)$

Keiith This is your answer

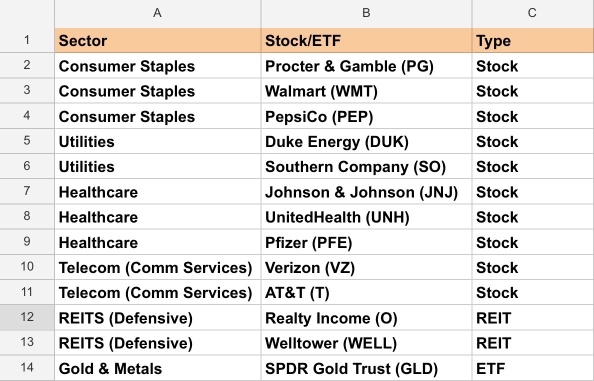

In times of stock market crashes or economic downturns, defensive sectors are those that tend to perform relatively better because they provide essential goods and services that people need regardless of economic conditions. These sectors are less sensitive to business cycles and usually have stable earnings, steady cash flows, and consistent dividends.

Here are the main defen...

Keiith This is your answer

In times of stock market crashes or economic downturns, defensive sectors are those that tend to perform relatively better because they provide essential goods and services that people need regardless of economic conditions. These sectors are less sensitive to business cycles and usually have stable earnings, steady cash flows, and consistent dividends.

Here are the main defen...

8

6

1

$Procter & Gamble (PG.US)$ I’ll not buy expensive defense names. Their earnings power is not as resilient as you think given China’s tariff on imports.

1

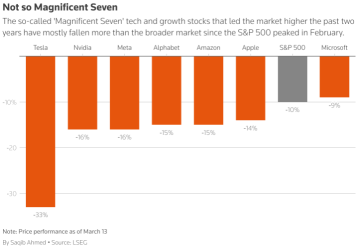

$Procter & Gamble (PG.US)$ i always look at pg and msft (and aapl sometimes) for relative valuation of defense and tech/momentum stocks. Right now msft is about 10% more expensive than pg based on foward p/e. valuation risk of tech is removed, but the market appears to be very concerned of tech earnings risks given the terrible technicals. there seems no bull case for tech.

$Procter & Gamble (PG.US)$ today is tech

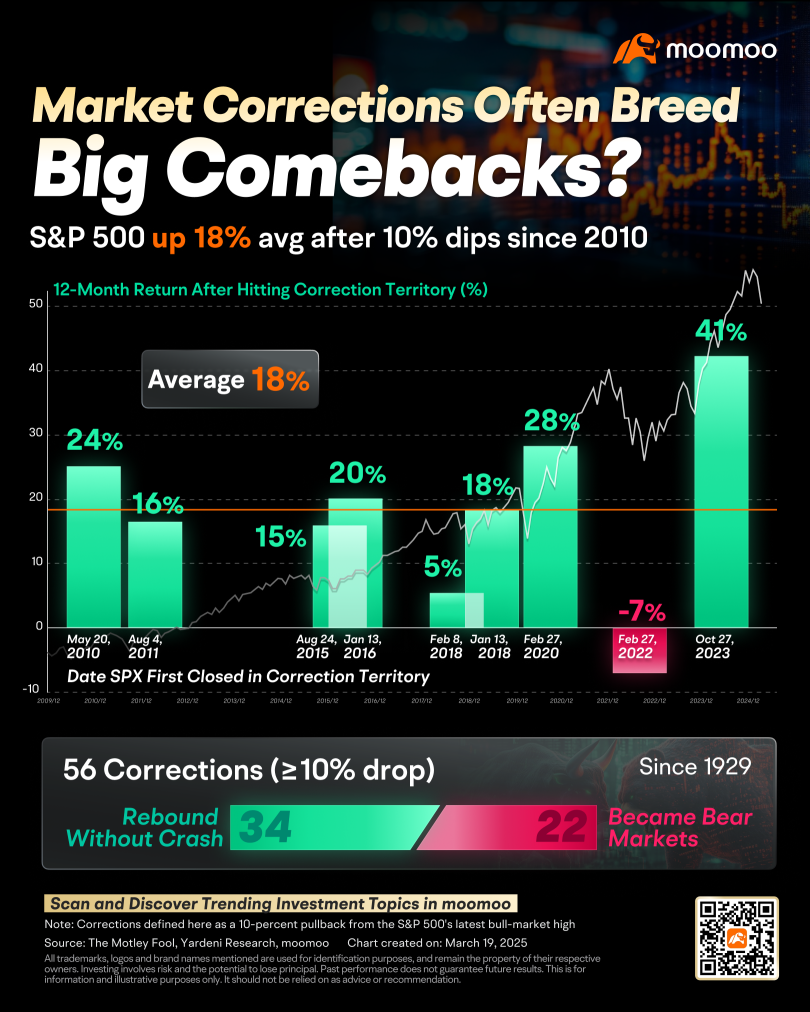

Market Status: Multiple Pressures Behind the Correction

On March 18, the S&P 500 closed at 5,614.66, down 10.1% from its February 19 peak, marking the first correction since October 2023. This decline occurred in just 3.5 weeks, much faster than the nearly 3-month correction in 2023. The index erased all gains from the "Trump rally" since November 2024, reflecting concerns over tariffs, stagflation, and supply chain issues...

On March 18, the S&P 500 closed at 5,614.66, down 10.1% from its February 19 peak, marking the first correction since October 2023. This decline occurred in just 3.5 weeks, much faster than the nearly 3-month correction in 2023. The index erased all gains from the "Trump rally" since November 2024, reflecting concerns over tariffs, stagflation, and supply chain issues...

84

3

142

No comment yet

72714159 : fake wsj news. trump can cut but china might not

Will-RA : Damn, Trump thinks he has opened a lot of long positions.

Hoopski : China called Trumps bluff , and he got caught selling wolf tickets !!

No more money : here comes another bluff, you think he will really cut with his arrogance of his? it's just another gain event for his insiders

胖胖的小弟 72714159 : Other countries have not officially joined yet; it has been postponed by 90 days.

View more comments...