US OptionsDetailed Quotes

NFG250516P40000

- 0.00

- 0.000.00%

15min DelayTrading Apr 28 09:30 ET

0.00High0.00Low

0.00Open0.00Pre Close0 Volume0 Open Interest40.00Strike Price0.00Turnover0.00%IV48.72%PremiumMay 16, 2025Expiry Date0.00Intrinsic Value100Multiplier18DDays to Expiry0.00Extrinsic Value100Contract SizeAmericanOptions Type--Delta--Gamma1560.00Leverage Ratio--Theta--Rho--Eff Leverage--Vega

National Fuel Gas Stock Discussion

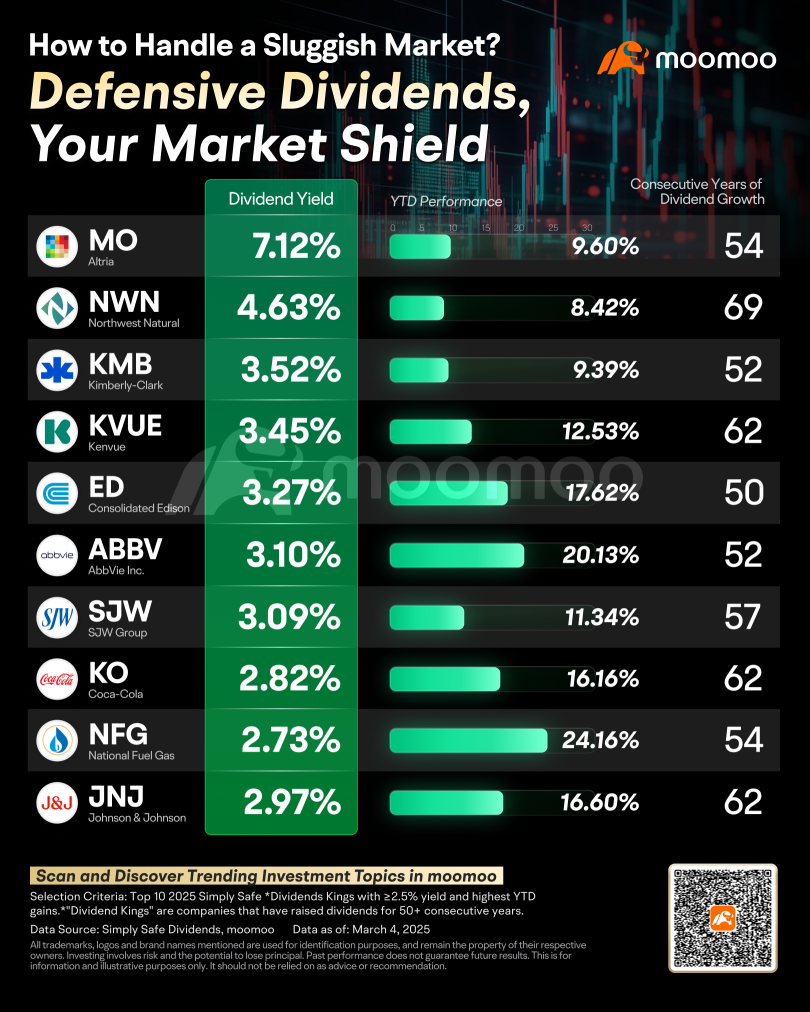

Columns Navigating a Sluggish Market: Building a Defensive Dividend Portfolio for Steady Passive Income

When the stock market takes a nosedive due to economic and political uncertainties, you might wonder whether holding high dividend stocks is a smart move. Research suggests high dividend stocks can provide steady income during market downturns caused by economic and political uncertainties, but their performance varies. The answer isn't a simple yes or no—it depends on several factors.

Why High Dividen...

Why High Dividen...

87

10

51

CEO David P. Bauer sees the new share repurchase program as a sign of the business's strong outlook and a way to boost shareholder value. However, the company admits that repurchases depend on factors like stock price, market conditions, and regulatory requirements.

The surprising drop in share price despite the company's move to profitability may indicate unresolved challenges. The company's worse performance last year compared to the annualised loss of 0.5% over the last half decade could be a bad sign for long term share price. However, the company's dividend payments have contributed to a higher TSR.

Despite National Fuel Gas's forecast growth aligning with the market, its lower P/E suggests investor skepticism about future growth expectations. The company's earnings instability may be pressuring the P/E ratio.

Based on the consistent ROCE trend, investors are advised to look further into National Fuel Gas as it could potentially become a multi-bagger, despite the stock only gaining 15% over the past five years.

1

Columns Notable Earnings 5/5

There are some good ones Thursday. A couple big names in tech. Remember that tech earnings are either a make or break in this high interest rate environment. Bad earnings are severely punished. Even if they beat estimates if they point towards a troubled second quarter then they might get punished as well. That goes for most earnings in this bear market. Especially tech so be careful. Basically these tech companies must show that that are making revenue and future revenu...

+4

3

9

1

The Dow Jones Industrial Average plunged Monday as the Ukraine-Russia war sent oil prices higher again. $Apple (AAPL.US)$ , $Amazon (AMZN.US)$ and $Netflix (NFLX.US)$ fell despite bullish analyst calls. $Visa (V.US)$ and $MasterCard (MA.US)$ dipped after suspending operations in Russia.

A trio of stocks managed to test buy points despite the bearish action. Railroad play $CSX Corp (CSX.US)$ , gold play $Newmont (NEM.US)$...

A trio of stocks managed to test buy points despite the bearish action. Railroad play $CSX Corp (CSX.US)$ , gold play $Newmont (NEM.US)$...

9

As fuel prices continue to rocket, travel stocks are selling off. Meanwhile, travel booking and hotel stocks were also among Monday's worst performers. U.S. Global Jets $U.S. Global Jets ETF (JETS.US)$ an ETF that tracks airline stocks, fell nearly 9%.

Gold miners and oil stocks led the upside among the industry groups. These industry groups continue to provide a fair amount of breakouts for investors looking to stay active in the market. But the stock market remai...

Gold miners and oil stocks led the upside among the industry groups. These industry groups continue to provide a fair amount of breakouts for investors looking to stay active in the market. But the stock market remai...

5

$Archaea Energy (LFG.US)$

De-spac Play (M&A closed: 9/15/21) currently undervalued

LFG is the Leading Renewable Natural Gas (RNG) Company through the simultaneous merger of Aria Energy and Archaea Energy

Sector Opportunity:Natural Gas has seen a major price increase based on Hurricane Ida, up 80% YTD and 31% last month; LFG is tracking that performance up 79% YTD and 32% last month; Goldman thinks the price of Natural Gas could double and recently invested $40M

Revenue:$204M, growing at 38% CAGR; 2x better than the competitors

Profitability:Day 1 profitable $40M in ‘20; In ’21, $65M, 38% margin; 10x EBITDA growth in 5 years; 3x better than the competitors

Valuation:Trading at ~16x 2022 EV/EBITDA, Comps trading at 31x; Implies the stock is currently undervalued and could double

Analyst coverage:PT $32 based on Ortex data, implies a 66% upside

Institutions:Very high Ownership Accumulation Score on fintel, (Ranked 93 out of 21,606 companies); 72 Institutional Investors; Goldman recently invested $40M

Stock:Up 30% in the last month; 100% upside based on comps: PT $40 Thinly traded stock with no shares to borrow, major volume spike could really drive price higher

Catalysts:Natural gas price increases, Initiation reports from more established banks, continued institution buying,

$National Fuel Gas (NFG.US)$ $Ultrapar Participacoes (UGP.US)$ $Atmos Energy (ATO.US)$

De-spac Play (M&A closed: 9/15/21) currently undervalued

LFG is the Leading Renewable Natural Gas (RNG) Company through the simultaneous merger of Aria Energy and Archaea Energy

Sector Opportunity:Natural Gas has seen a major price increase based on Hurricane Ida, up 80% YTD and 31% last month; LFG is tracking that performance up 79% YTD and 32% last month; Goldman thinks the price of Natural Gas could double and recently invested $40M

Revenue:$204M, growing at 38% CAGR; 2x better than the competitors

Profitability:Day 1 profitable $40M in ‘20; In ’21, $65M, 38% margin; 10x EBITDA growth in 5 years; 3x better than the competitors

Valuation:Trading at ~16x 2022 EV/EBITDA, Comps trading at 31x; Implies the stock is currently undervalued and could double

Analyst coverage:PT $32 based on Ortex data, implies a 66% upside

Institutions:Very high Ownership Accumulation Score on fintel, (Ranked 93 out of 21,606 companies); 72 Institutional Investors; Goldman recently invested $40M

Stock:Up 30% in the last month; 100% upside based on comps: PT $40 Thinly traded stock with no shares to borrow, major volume spike could really drive price higher

Catalysts:Natural gas price increases, Initiation reports from more established banks, continued institution buying,

$National Fuel Gas (NFG.US)$ $Ultrapar Participacoes (UGP.US)$ $Atmos Energy (ATO.US)$

3

1

No comment yet

BelleWeather : This won’t work either.

D Blaine : ‘ dividends don’t lie.’ yes they can be cut, or even eliminated, but generally, they are safe.

102875548 : Buy warren company... go check the past 3 times market dived deep from Aug 5, Sept and recently.

You will be surprised

Blue Jets : I agreed. but this list is not the highest dividend out there and the companies in this list is not undervalued nor fairly price

TradeView : the best now is holding cash!

View more comments...