No Data

GS250502C560000

- 3.62

- -0.55-13.19%

- 5D

- Daily

News

Boeing, Goldman Sachs Share Gains Contribute To Dow's 280-Point Jump

Opening: US stocks opened slightly higher on Monday. This week the market focuses on Earnings Reports and economic data.

On the evening of April 28, Peking time, U.S. stocks opened slightly higher on Monday. Over 180 S&P component stocks, including Microsoft, Apple, Amazon, and Meta, will release their Earnings Reports this week. Important data such as non-farm employment and GDP will also be released this week. Investors continue to pay attention to the progress of trade negotiations. China has once again clarified that there are no negotiations or discussions on tariff issues between China and the U.S.

Market Chatter: Goldman Sachs Advising Nations on Managing US Trade Tensions

Goldman Sachs (GS.US) Chairman Su Dewei: Tariffs may have a huge potential impact on the profitability of enterprises.

Su Dewei stated that discussions regarding tariffs may have an impact on business sentiment and could bring significant potential effects on corporate profits and losses.

Goldman Sachs: Maintains CHINA TOWER 'Neutral' rating and lowers Target Price to 12.5 HKD.

Goldman Sachs released a research report stating that CHINA TOWER (00788) performed in line with previous guidance in the first quarter, with revenue and Net income increasing by 3.3% and 8.6% year-on-year, respectively. In response to the first quarter's performance, Goldman Sachs has lowered the revenue forecasts for CHINA TOWER by 0.8%, 1.4%, and 1.4% for 2025 to 2027, and cut the Net income forecasts by 3.7%, 4.1%, and 4.3%. The Target Price has been reduced from 13 HKD to 12.5 HKD, with a rating of 'Neutral'. Investors are generally concerned about the slowdown in the growth rate of the dividend payout ratio and the decline in telecom operators' 5G-related capital expenditures. Goldman Sachs noted that most tower-type Assets will reach the point of depreciation.

Will the US Stock Market's Rebound Ignite Your Next Trade?

Comments

If you’re investing or trading right now, you need to be mentally prepared for that.

Stocks covered in my video (technical analysis) – SPY, Apple, Tesla, Google, Meta, Microsoft, Nvidia + Option trades

$Salesforce (CRM.US)$ $Visa (V.US)$ $MasterCard (MA.US)$ $Starbucks (SBUX.US)$ $McDonald's (MCD.US)$ $PepsiCo (PEP.US)$ $Target (TGT.US)$ $Walmart (WMT.US)$ $Costco (COST.US)$ $iShares Bitcoin Trust (IBIT.US)$ $Arm Holdings (ARM.US)$ $JPMorgan (JPM.US)$ $Goldman Sachs (GS.US)$ $Bank of America (BAC.US)$ $Disney (DIS.US)$ $Grab Holdings (GRAB.US)$ $Sea (SE.US)$

This show a positive trend in early trading and buying interest was fueled by the reports that President Trump exempted items like smartphones, semiconductors, and other electronics from tariffs.

But S&P 500 only managed to close 0.8% higher than previous week Friday after it went negative brie...

Gapping Up

$Apple (AAPL.US)$ gained 6.3% after the Trump administration temporarily exempted smartphones, laptops, and key electronic components from new 145% tariffs on Chinese goods. Issued late Friday by U.S. Customs and Border Protection, these exemptions boosted tech stocks. Nonetheless, President Trump and Commerce Secretary Howard Lutnick warned that the relief might be temporary.

$Intel (INTC.US)$ shares incr...

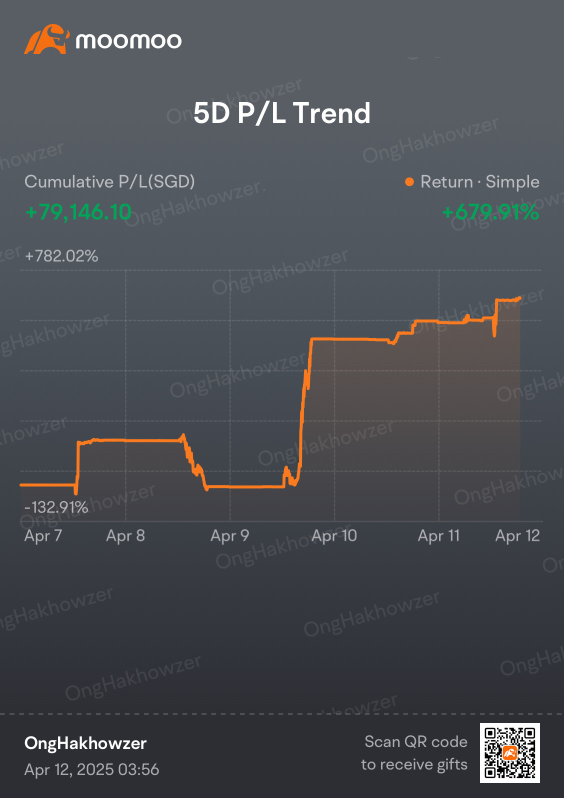

What a wild week it has been! The markets were rocked by tariff news and a series of dramatic twists and turns. Last week kicked off with a sharp sell-off, as $E-mini NASDAQ 100 Futures(JUN5) (NQmain.US)$ plummeted over 4%. The fear index spiked as investors braced for another wave of trade tensions. However, the story quickly took a strange turn when rumors circulated that Trump was considering a 90-day suspension of tariffs. Th...

️

️ , Tariffs Exempt Apple, Nvidia: Can Buy Now? Hope this helps a little in navigating the volatility!

, Tariffs Exempt Apple, Nvidia: Can Buy Now? Hope this helps a little in navigating the volatility!