No Data

Shell Is Said to Weigh BP Takeover as Energy Sector Pressures Mount

Weekly Earnings Scorecard: 4 Out of 6 Energy Stocks Post Earnings Wins

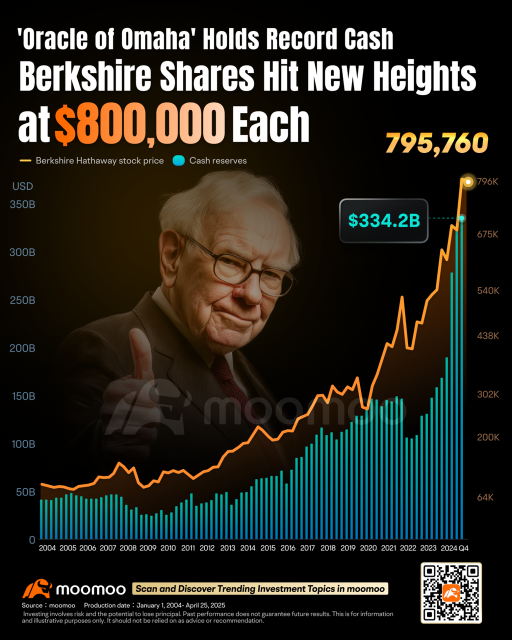

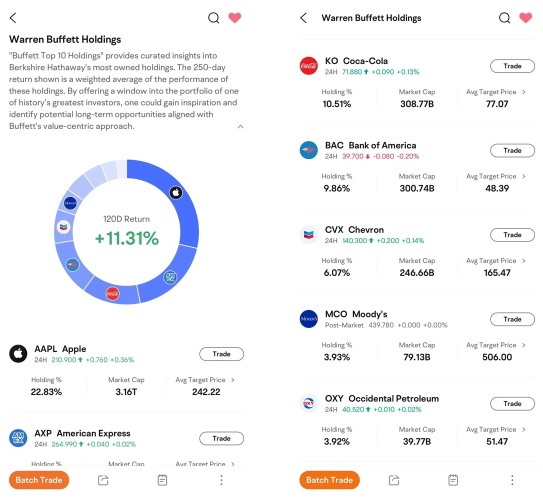

Warren Buffett Owns Chevron and Occidental. Should You Buy This Energy Giant Instead?

About 78% of the Names That Reported Earnings This Week Delivered EPS Wins: Earnings Scorecard

Despite Lower Oil Prices, Chevron's Strategy Continues to Pay Dividends for Investors

Shell is studying the feasibility of acquiring BP PLC while its competitors' stock prices are plummeting.

According to sources, Shell is working with advisors to assess the possibility of acquiring BP PLC, but the company is waiting for a further drop in stock prices and oil prices before deciding whether to make a bid. Sources indicate that, in recent weeks, the oil giant has been discussing the feasibility and benefits of acquiring BP PLC in more depth with the advisors, and the final decision is likely to depend on whether BP PLC's stock prices continue to decline. Due to its transformation plan failing to win investor favor, coupled with the plummet in oil prices, BP PLC's stock price has dropped nearly one-third in the past 12 months. Some insiders mentioned that

Ttowbin23 : we are still sucking oil for energy uses

105232125 : doubtful

PAUL BIN ANTHONY : Thank you, sir.

juwanda :