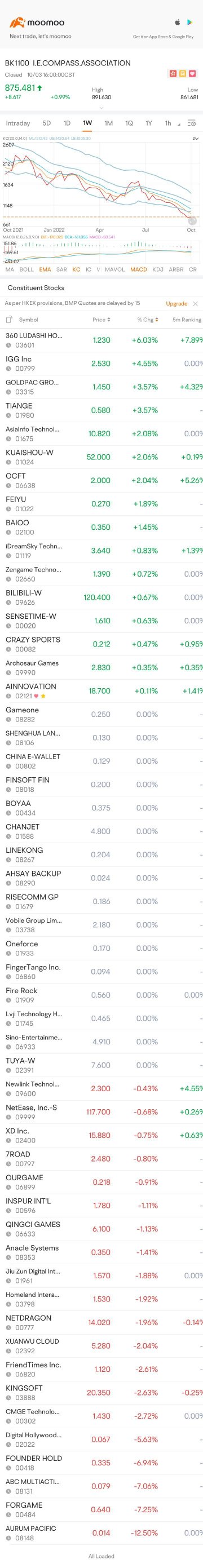

Application Software

- 1400.097

- +7.696+0.55%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

Technology stocks are rebounding, while high-profile stocks are collectively "cooling down". The market may enter a critical period for switching between high and low performances.

Track the entire lifecycle of the main Sector.

As the market warms up, Chinese concept stocks are facing a dual choice, and the Hong Kong market may return to being the center of IPOs.

① In the changing landscape of Global trade, Hong Kong, as an international financial center, will welcome a new development scenario, implementing various measures to strengthen its unique market position as a "super connector"; ② Foreign Analysts point out that the delisting risk faced by Chinese concept stocks may lead Hong Kong to become an IPO center once again; ③ It is worth noting that, under the delisting risk for Chinese concept stocks, a choice will be made between returning to the A-share or Hong Kong stock market.

Under the Deepseek effect, Goldman Sachs puts cold water on the Datacenter boom: the Global Datacenter utilization rate has reached its peak.

From the release of DeepSeek, which is a low-cost competitor to ChatGPT, to Microsoft scaling back its Global AI Datacenter projects, and Alibaba Director Zhang Yong warning about a bubble in USA AI infrastructure investments, multiple warning signals are flashing: the boom in AI Datacenters may soon be facing a cool down.

Brokerage morning meeting highlights: The impact of tariff increases is complex, focus on two investment main lines.

In today's brokerage morning meeting, GTJA HAITONG SEC stated that the impact of tariff increases is complex and attention should be paid to two investment main lines; Huaxi believes that the subsequent market trend in the equity market is expected to exhibit a rebound from overselling; China International Capital Corporation suggested to pay attention to the temporary overweight high dividend and policy-benefiting symbols in China Stocks, and to the rebound from overselling in Technology Stocks.

Choosing between A-shares or Hong Kong stocks, Technology or non-Technology? Goldman Sachs' Research Reports respond to two major hot topics in investing in China.

① Currently, should investors continue investing in Hong Kong Stocks or shift to the A-share market? Should the focus be on the Technology Sector or shift to Consumer, Real Estate, and other non-Technology sectors? ② On Wednesday, Goldman Sachs' chief China Stocks strategist, Liu Jinjing, provided an analysis in his report.

After the low-key release of DeepSeek-V3, the industry was shocked and once again questioned the Silicon Valley model.

① DeepSeek released the V3-0324 model on Monday evening, with preliminary tests showing that it can run on Consumer-grade Hardware, breaking the traditional notion that large models require a Datacenter; ② DeepSeek's model continues to reduce the energy consumption and computing costs of large models while maintaining an open-source approach to continuously drive technological innovation, leading to the rapid development of the domestic AI Industry and raising questions about Silicon Valley's closed and paid model.

子伍 : Friends, are you also watching Hong Kong stocks?