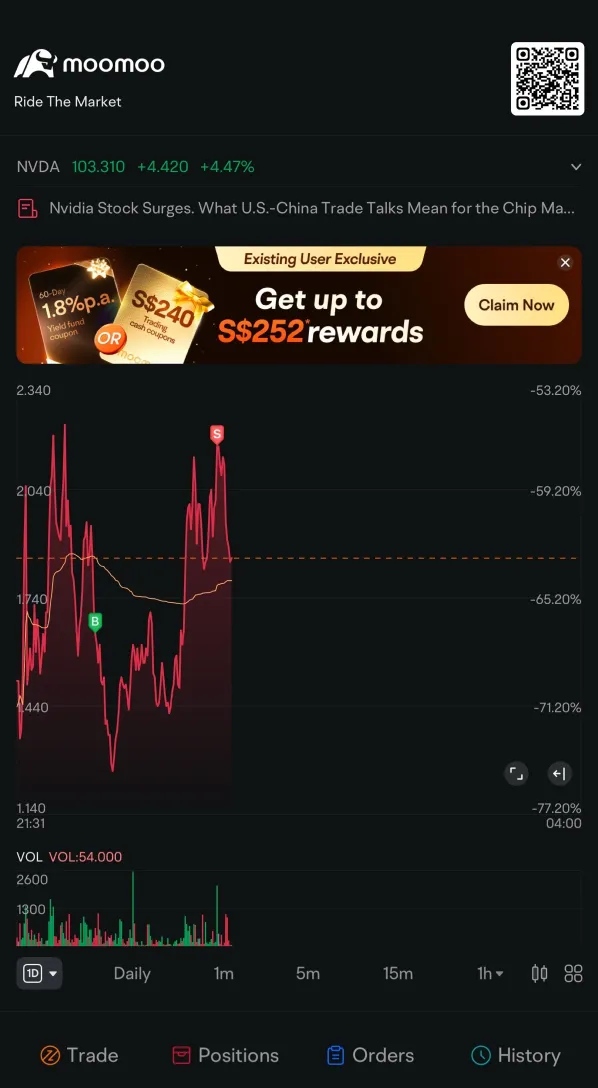

No Data

BAC250502P29000

- 0.01

- 0.000.00%

- 5D

- Daily

News

Opening: US stocks opened slightly higher on Monday. This week the market focuses on Earnings Reports and economic data.

On the evening of April 28, Peking time, U.S. stocks opened slightly higher on Monday. Over 180 S&P component stocks, including Microsoft, Apple, Amazon, and Meta, will release their Earnings Reports this week. Important data such as non-farm employment and GDP will also be released this week. Investors continue to pay attention to the progress of trade negotiations. China has once again clarified that there are no negotiations or discussions on tariff issues between China and the U.S.

Morgan Stanley strategist Wilson: The weakness of the dollar will support US stocks outperforming Other global markets.

Michael Wilson of Morgan Stanley stated that a weaker dollar will support corporate earnings in the USA, helping American stocks outperform Other global markets. As many Wall Street strategists believe the era of American exceptionalism is coming to an end, Wilson uniquely believes that the USA remains a relatively good investment choice. He pointed out that the lower volatility of corporate earnings growth and the perception of higher quality among American companies are other reasons supporting this view. "We are still in the later stage of the cycle, where high-quality firms and large-cap stocks are expected to continue to perform well," he wrote in a report on Monday. Wilson expects

Oppenheimer Adjusts Price Target on Bank of America to $51 From $50, Maintains Outperform Rating

Warren Buffett Stands Tall as U.S. Stocks Tumble: How the 'Oracle' Is Tackling Tariff Impacts?

Bank of America Securities: Raised HANSOH PHARMA's Target Price to 29 Hong Kong dollars and reiterated a "Buy" rating.

Bank of America Securities released a Research Report stating that HANSOH PHARMA (03692) saw a 76.9% surge in sales of almonertinib in the first two months of this year, driving strong sales performance for the company. As a result, the revenue forecasts for 2025, 2026, and 2027 have been raised by 1.9%, 2.5%, and 2.7% respectively, and the Target Price has been increased from HKD 24.8 to HKD 29. Due to its robust R&D capabilities and the expansion of indications for existing major products, the rating is reiterated as "Buy."

Will the US Stock Market's Rebound Ignite Your Next Trade?

Comments

It’s been an eventful week in the markets, with a dramatic shift in sentiment from Monday’s bearish close to a four-day rally starting Tuesday. This change resulted from improving tariff dynamics and slightly better-than-expected earnings reports. As a result, $NASDAQ 100 Index (.NDX.US)$ surged 6.43% for the week, $S&P 500 Index (.SPX.US)$ rose 4.59%, and $Russell 2000 Index (.RUT.US)$ gained 4.09%, reflecting str...

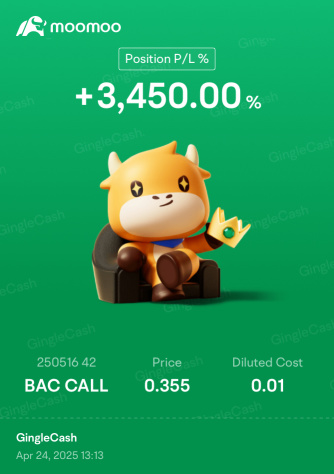

$Bank of America (BAC.US)$

Is Bank of America Corp. (NYSE:BAC) the Best Stock Under $100 to Buy According to Hedge Funds?

Will add more puts once we reach the top again.

GainzGetter : lol my trade wasn't SPDN it was SPY, nice try though

74128907 : Some are happy while others are sad.![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

來賺錢 : Is the fee policy the CAT fee?

ElCarnisero : goood

Goldenboy71447322 : There are resources to undertake, which I still do not know.

View more comments...