No Data

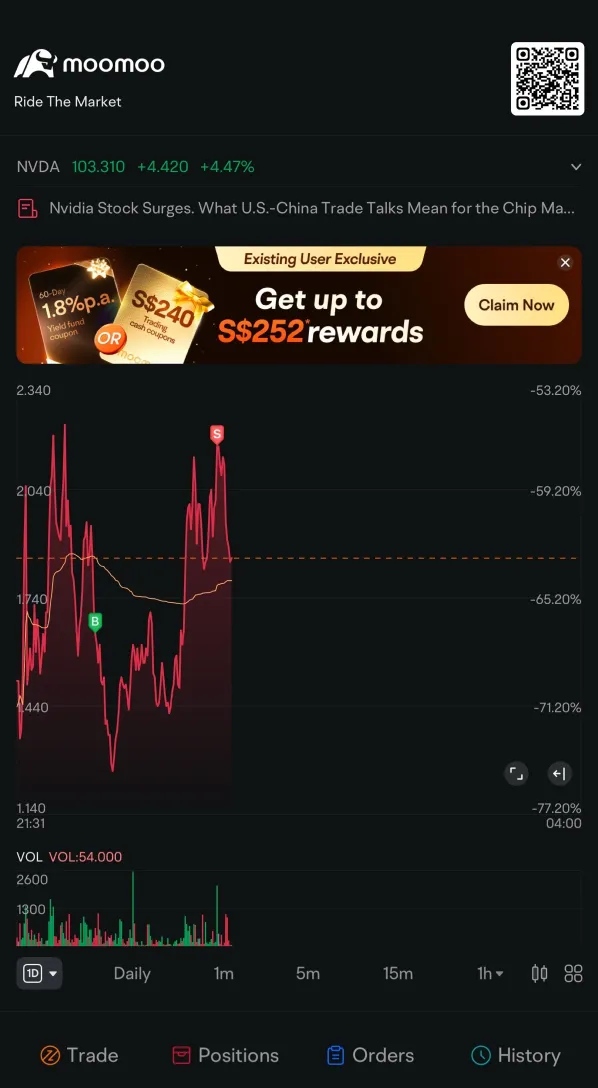

BAC250502C34000

- 5.85

- 0.000.00%

- 5D

- Daily

No Data

News

Oppenheimer Adjusts Price Target on Bank of America to $51 From $50, Maintains Outperform Rating

Warren Buffett Stands Tall as U.S. Stocks Tumble: How the 'Oracle' Is Tackling Tariff Impacts?

Bank of America Securities: Raised HANSOH PHARMA's Target Price to 29 Hong Kong dollars and reiterated a "Buy" rating.

Bank of America Securities released a Research Report stating that HANSOH PHARMA (03692) saw a 76.9% surge in sales of almonertinib in the first two months of this year, driving strong sales performance for the company. As a result, the revenue forecasts for 2025, 2026, and 2027 have been raised by 1.9%, 2.5%, and 2.7% respectively, and the Target Price has been increased from HKD 24.8 to HKD 29. Due to its robust R&D capabilities and the expansion of indications for existing major products, the rating is reiterated as "Buy."

Market Technical Analysis: Will the US Stock Market's Rebound Ignite Your Next Trade?

Bank of America Securities: Downgraded Great Wall Motor's Target Price to 12.8 HKD as the first quarter performance was below expectations.

Bank of America Securities released a Research Report stating that Great Wall Motor (02333) plans to launch several new models this year to increase sales. Considering the first quarter performance, Bank of America adjusted the sales forecast for this year to 2027 down by 0.3% each, the gross margin forecast decreased by 2.5, 2.3, and 1.6 percentage points respectively, and the net income forecast was lowered by 15%, 10%, and 8% respectively. The bank lowered the Target Price for Great Wall Motor's H shares from HKD 14.6 to HKD 12.8, maintaining a "Neutral" rating. The company's sales in the first quarter decreased by 7% year-on-year to 40 billion yuan (same below), and sales volume also decreased by 7% year-on-year, mainly due to the period.

Trump's promise of "unprecedented prosperity" is still fresh in memory, yet the U.S. stock market has been left battered and bruised in his first 100 days in office.

Donald Trump promised that if he was elected President of the USA, he would lead Americans to unprecedented prosperity. However, judging by the performance of US stocks in the first 100 days of his presidency, this 'prosperity' is open to interpretation. The market's experience during this time can certainly be described as explosive, but it has not unfolded as investors expected. April 30 marks 100 days since Trump took office. Despite the recent increase, the S&P 500 Index has fallen about 8% since Trump's inauguration, which is set to become the worst performance of US stocks within the first 100 days of a president since Gerald Ford took over the White House in 1974.

Comments

It’s been an eventful week in the markets, with a dramatic shift in sentiment from Monday’s bearish close to a four-day rally starting Tuesday. This change resulted from improving tariff dynamics and slightly better-than-expected earnings reports. As a result, $NASDAQ 100 Index (.NDX.US)$ surged 6.43% for the week, $S&P 500 Index (.SPX.US)$ rose 4.59%, and $Russell 2000 Index (.RUT.US)$ gained 4.09%, reflecting str...

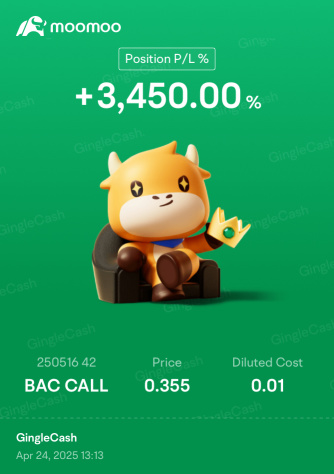

$Bank of America (BAC.US)$

Is Bank of America Corp. (NYSE:BAC) the Best Stock Under $100 to Buy According to Hedge Funds?

Will add more puts once we reach the top again.

GainzGetter : lol my trade wasn't SPDN it was SPY, nice try though

74128907 : Some are happy while others are sad.![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

來賺錢 : Is the fee policy the CAT fee?

ElCarnisero : goood

Goldenboy71447322 : There are resources to undertake, which I still do not know.

View more comments...