No Data

7261 Mazda Motor

- 852.1

- +8.7+1.03%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

The Nikkei average fell by 429 yen, a significant decline for the first time in three days, dominated by sell-offs due to a stronger yen = 21st morning session.

On the 21st, the Nikkei average stock price in the morning session fell significantly by 429.93 yen to 34,300.35 yen, marking a drop for the first time in three days. The TOPIX (Tokyo Stock Price Index) also decreased by 30.14 points to 2,529.01 points. Since the USA market was closed on Good Friday on the 18th, a reduction in buying and selling Orders from Overseas investors was expected, and selling was prioritized as the yen appreciated against the dollar. The Nikkei average reached 34,297.76 yen at 10:08 AM. After that, the market began to recover.

The Nikkei average is down about 360 yen, with the top declining stocks including Sumitomo Pharma, Suzuki, J. Front ETC.

On the 21st, around 11 AM, the Nikkei average stock price fluctuated around 34,370 yen, down approximately 360 yen from the previous weekend. At 10:08 AM, it hit a low of 34,297.76 yen, down 432.52 yen. Due to the continuation of the upward trend until the previous weekend, selling pressure emerged from the morning. With the exchange rate shifting towards yen appreciation, there has been a soft price movement. Among the stocks included in the Nikkei average, notable decliners include Sumitomo Pharma <4506.T>, Suzuki <7269.T>, and J. Front <3086>.

Mazda to Pause U.S. Production of Compact SUV Destined for Canada

<Rating Change Observation> Downgrades for New, GS Yuasa, Shimadzu, and Kyowa Kirin, etc.

◎New and Resuming Asahi <2502.T> --- A major domestic player is in the middle of three stages (coverage resumed) Kirin HD <2503.T> --- A major domestic player is in the middle of three stages (coverage resumed) Coca-Cola <2579.T> --- A major domestic player is in the middle of three stages (coverage resumed) Suntory BF <2587.T> --- A major domestic player is in the middle of three stages (coverage resumed) Minebea M <6479.T> --- A major domestic player is in the middle of three stages Mabuchi <6592.T> --- A major domestic player is in the middle of three.

Amada, Mitsui & Co., etc. [List of stock materials from newspapers]

* AMADA <6113> enters the Semiconductors equipment market, acquiring board processing machines for 51 billion yen (Nikkei Industrial Front Page) - ○ * MAZDA MOTOR CRP <7261> flexibly responds to U.S. 'CX-50', considering production halt to Canada (Nikkei Industrial Front Page) - ○ * Yaskawa Electric <6506> responds to U.S. tariffs by passing on costs and building a Global supply chain (Nikkei Industrial Front Page) - ○ * MISUMI Group <9962> acquires U.S. Machinery Components procurement to expand digital and customer base (Nikkei Industrial Front Page) - ○ * JR Kyushu <9142> sells 'Queen Beetle' to a South Korean transportation company.

U.S. retail revenue saw a significant increase for the first time in two years, with a rush of demand in Autos.

In March, U.S. retail revenue saw an increase of 1.4% from the previous month (up 0.2% in February), marking the largest rise in two years. This surge in automobile sales contributed to the increase. It seems that consumers hurried to make purchases before tariffs on Autos were raised. <7201> Nissan <7202> Isuzu <7203> Toyota <7211> Mitsubishi <7261> MAZDA MOTOR CRP <7267> Honda <7269> Suzuki <7270>

Comments

US Market

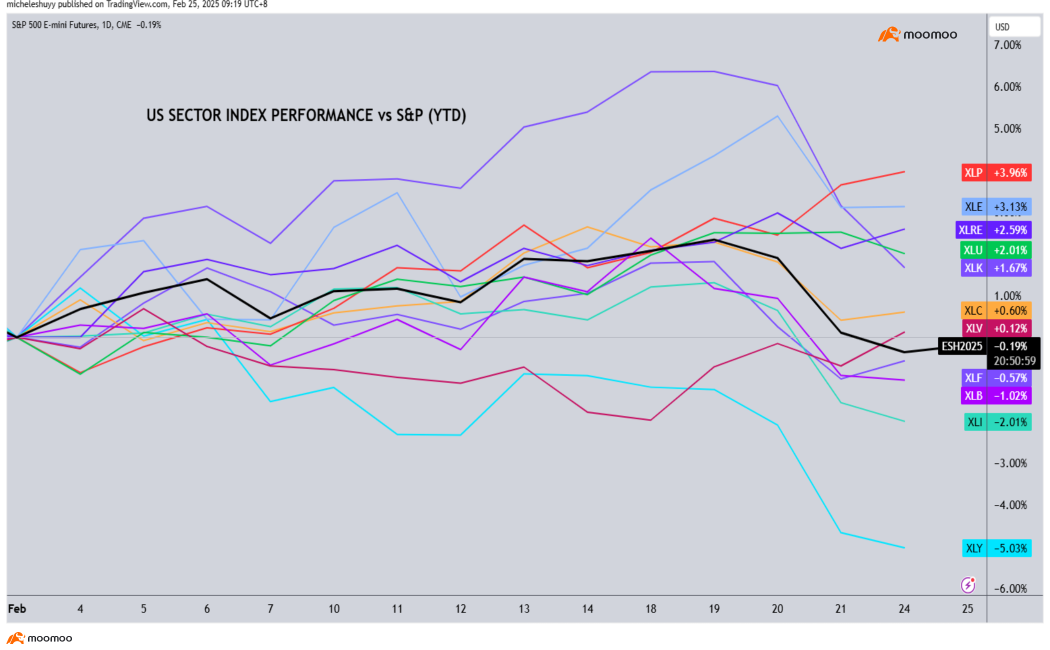

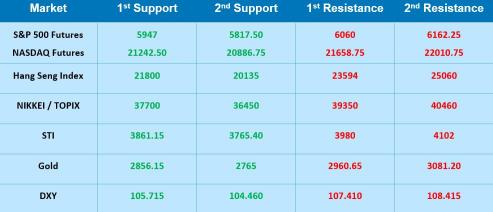

US markets ended the week lower, with the $E-mini S&P 500 Futures(JUN5) (ESmain.US)$ and $E-mini NASDAQ 100 Futures(JUN5) (NQmain.US)$ falling 1.78% and 2.50% respectively. This came after economic data revealed that consumers' long-term inflation expectations had surged to their highest level in nearly three decades. Investor sentiment took another hit as Trump threatened to impose 25%...

Lululemon Athletica Inc (LULU US) $Lululemon Athletica (LULU.US)$

Daily Chart - [BEARISH ↘ **] LULU US traded sideways before breaking down lower. With bearish divergence being posted, a further push lower below resistance at 371.88 towards 318.24 support is expected. Price is now below 34 period EMA with MACD showing a build up in bearish divergence.

Alternatively: A daily candlestick closing above 371.88 resistance will invalidate bear...

$E-mini S&P 500 Futures(JUN5) (ESmain.US)$ (4 Hour Chart) -[BULLISH↗ **]We maintain our bullish directional bias. Price is currently near 6055 resistance level. A 4 hour candlestick closing above 6055 resistance would open push towards 6120 resistance level. Technical indicators are advocating for a bullish scenario as well.

Alternatively: A 4 hour candlestick closing below 6055 resistance would...

Cui Nyonya Kueh : Today no class, never announce.![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

Cui Nyonya Kueh : but thank you still !![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

Trader’s Edge OP Cui Nyonya Kueh : Next week we will resume! Thank you for your support as always!![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

Cui Nyonya Kueh Trader’s Edge OP :

Devip : Year-to-date, there’s been a clear capital shift away from U.S. equities and into ex-U.S. markets. Is the music stopping for U.S. equities?

View more comments...