No Data

.JPXN400 JPX-Nikkei Index 400 (© JPX Market Innovation & Research, Inc., Nikkei Inc.)

- 23467.900

- +49.410+0.21%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

Recovery to 35,000 yen due to easing of US-China trade tensions and expectations from the Japan-US finance ministers' meeting.

The Nikkei average continued to rise, finishing the day at 35,039.15 yen, up 170.52 yen, recovering the 35,000 yen mark for the first time in three weeks with an estimated Volume of 1.8 billion 80 million shares. The U.S. market on the 23rd rose on expectations of easing U.S.-China trade tensions following reports from U.S. Broadcasting that the Trump administration is considering lowering tariffs on China. Following this trend, the Tokyo market began with Buy activity focused on high-tech stocks, and the Nikkei average reached 35,287 shortly after the opening.

Is there new evidence for the "Sell USA" Trade? Japan Assets attract record inflow of funds.

According to preliminary weekly data released by Japan's Ministry of Finance on Thursday, overseas investors have net Bought 9.64 trillion yen (67.5 billion USD) of Japanese Bonds and Stocks so far in April; based on balance of payments data dating back to 1996, this level is already the highest net Inflow for any recorded month.

Verifying capital outflows from the USA market, Japanese stocks and bonds attracted a record amount of funds in April.

According to data released by Japan's Ministry of Finance on Thursday, as of April, overseas investors have net bought 9.64 trillion yen (approximately 67.5 billion USD) of Japanese Bonds and Stocks. This is the highest level ever recorded since 1996.

Sanwa HD - Sanwa Shutter Industry's "Wind Resistance Guard LS" has received the Excellence Award at the Japan Resilience Awards.

Sanwa Holdings <5929> announced on the 23rd that its subsidiary, Sanwa Shutter Industry, received an excellence award at the 'Japan Resilience Award (Strengthening Award) 2025' organized by the Resilience Japan Promotion Council for its wind-resistant lightweight shutter 'Wind Guard LS'. The 'Wind Guard LS' showcases high wind resistance performance during regular open and close operations without the need for special actions, thanks to its uniquely developed hook structure at the ends of the slats.

Stocks that moved and those that were traded in the front market.

*Nova Ltd <9519> 654 +49, upward revision of performance to reduce profit decline. *Nomura Micro Science <6254> 2360 +170, expected increase in year-end Dividends. *Sumitomo Electric Industries <5802> 2244 +163, riding the trend of rising Autos-related stocks. *Musashi Seimitsu Industry <7220> 2333 +160, funds are also moving toward Datacenter-related due to the rise in Semiconductors stocks. *Osaka Titanium Technologies <5726> 1624 +109, Boeing's increased production plan.

SBI securities (before the close) has a strong Sell on Toyota Motor, and a strong Buy on Mitsubishi Heavy Industries.

Sell Code Stock Name Trading Amount (6146) Disc 32,684,038,060 (7012) Kawasaki Heavy Industries 23,129,249,540 (7011) Mitsubishi Heavy Industries 20,024,708,695 (5803) Fujikura 15,841,982,880 (1570) NEXT FUNDS Nikkei Average Leverage Listed Investment Trust 13,881,358,873 (2432) DeNA 1

Comments

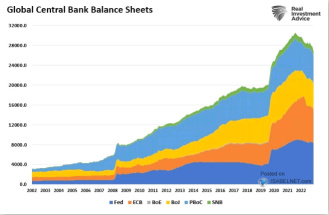

Liquidity is What Moves Markets

Investors worldwide pay very close attention to the Fed whenever they speak. They are searching for any inkling of a clue into future policy decisions. Ultimately, they are looking for the one thing that moves markets, and that would be liquidity.

Will they decrease interest rates? Will they add assets to their balance sheet? Will the Federal Reserve pump liquidity into the ...

if people believe the fed, then I have a 2008 story for you.

if people believe the fed, then I have a 2008 story for you.